- Sales of new vehicles priced above $100K in the US have surged by 333% since 2020.

- More than 52,000 six-figure vehicles were sold in the first two months of 2025.

- The Range Rover has been the top-selling model in the $100K club so far this year.

While you’ve been trying to keep your finances from going off the rails, luxury vehicles are having their moment again. Cox Automotive’s latest Kelley Blue Book report a rather surprising uptick in the number of people splurging on vehicles that cost six-figures.

If you’ve ever wondered just how deep some pockets are these days, prepare for a shock: luxury cars are flying off dealer lots, and you might feel a little behind if you don’t have at least $100K to throw down on a new ride.

In the first two months of 2025 alone, over 52,000 new vehicles priced above $100,000 were delivered in the USA. That’s an impressive 13% increase from the 46,000 sold last year, and a mind-boggling 333% spike compared to just five years ago, when only 12,000 six-figure cars were sold. So, it’s safe to say that many people aren’t just fantasizing about luxury anymore- they’re actually buying it.

Range Rover Leads the Pack

So, who’s winning the battle for six-figure supremacy? Somewhat surprisingly, the undisputed champion for 2025 is the Range Rover, which saw over 3,800 monthly sales in February alone. It seems that the British brand has secured its spot as the crown jewel of the six-figure crowd.

Erin Keating, an Executive Analyst at Cox Automotive, offered some perspective on the trend: “While affordability is a challenge for many households, six-figure vehicles continue to sell well and have experienced a four-fold increase in sales volume since early 2020.”

Keating also noted that the widening income gap is significantly influencing new vehicle sales trends, with high-income households and individuals with “prime” or “super prime” credit scores fueling much of the demand.

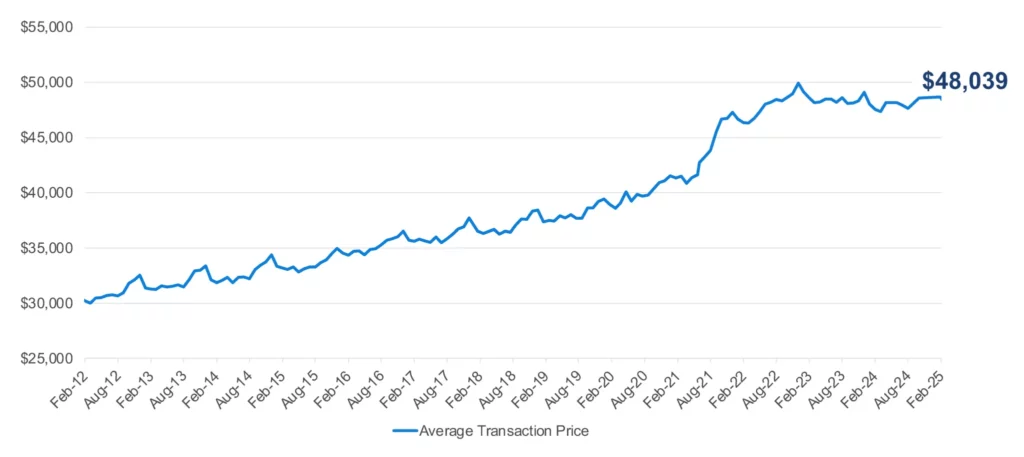

NEW-VEHICLE AVERAGE TRANSACTION PRICE

A Look at Average Transaction Prices

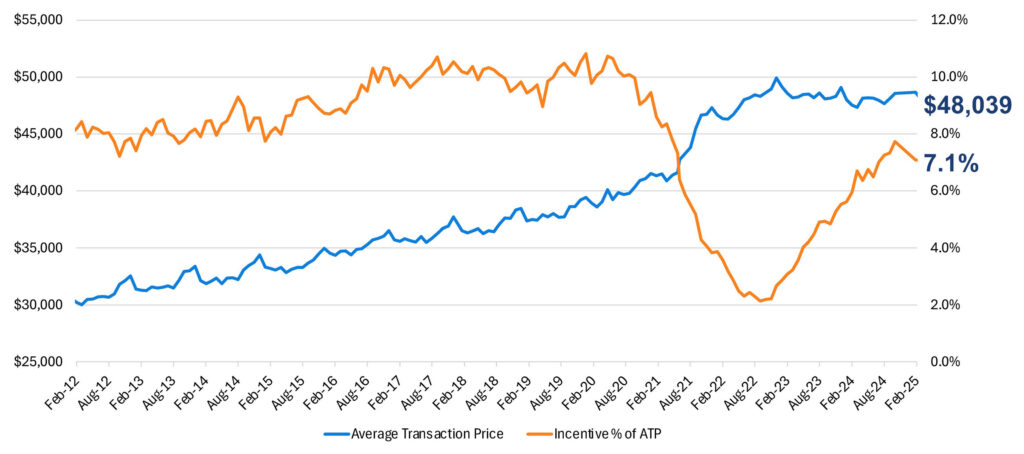

Now, let’s talk numbers, and specifically, the Average Transaction Price (ATP) for new vehicles. In February 2025, the Average Transaction Price (ATP) for a new vehicle was $48,039. That’s a 1.3% dip from January but still a 1% increase compared to the same time last year.

If you’re wondering which segments are pushing those ATPs above the $100K mark, look no further than the usual suspects: luxury full-size SUVs ($106,332), high-end luxury cars ($121,129), and high-performance vehicles ($121,322), all showing year-over-year growth. No surprises there, right?

Car Brands: Who’s Winning?

On the luxury brand front, Porsche takes the top spot with an ATP of $116,111 in February, which is 12% higher than last year. At the other end of the spectrum, Mitsubishi took the prize for the lowest ATP at $30,410, with Nissan not far behind at $32,262. So if you’ve been eyeing a luxury SUV or sports car, you now know who’s at the top of the price ladder.

More: Porsche May Add Another Gas-Powered SUV Next To Macan EV, Cayenne

For those who prefer a quieter ride with zero tailpipe emissions, electric vehicles are also in the mix. The average ATP for EVs in February stood at $55,273, down 1.2% from January but still up 3.7% from last year. EV incentives also saw a substantial rise, reaching an average of $8,162, the highest it’s been in over five years.

Keating also reflected on how much the overall automotive landscape has changed, noting, “February marks the five-year anniversary of the last ‘clean month’ of data prior to the global COVID pandemic that shifted the automotive landscape. Compared to February 2020, ATP is up 25% while incentives are down 13% and monthly sales are down 9%. Auto loan rates are higher now as well, making new-vehicle affordability a real challenge for most households.”

Average Transaction Prices Feb 2025 vs 2024

ATP VS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Lead image Urban Automotive