- Despite tariffs upsetting its US and European plans, China continues to export cars to the rest of the world.

- Many countries in the global south don’t have anti-China tariffs and have little to no local car industry to protect.

- Chinese automakers are now looking to expand their presence overseas, including moving manufacturing to new countries.

Even though US tariffs make Chinese-made cars as rare a sighting as snow in the desert over here, China’s automakers have managed to find enough buyers around the globe to propel the country past Germany and Japan as the leading exporter of passenger vehicles.

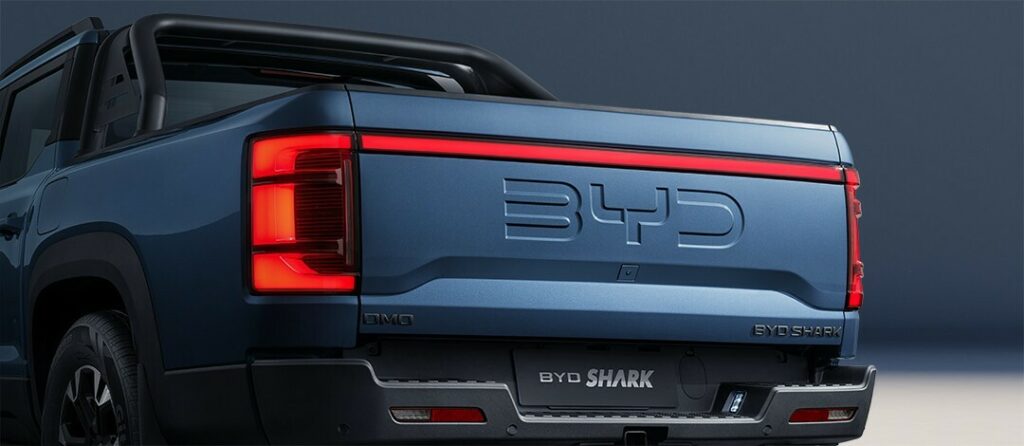

The growth has been exponential, with last year’s 4.7 million cars exported from China triple the amount of what it was in 2021. With BYD already surpassing Tesla in global sales (EVs and hybrids combined), analysts predict that Chinese automakers will soon overtake Volkswagen and Toyota.

Becoming The Best Of The Rest

However, with no notable success in North America, plus intense competition in Europe (not to mention tariffs on both sides), China has turned to the global south in an effort to shift its inventory. The South-East Asian, Middle Eastern, Latin American, and African markets are hot properties. Although individual nations in these regions may not have as strong buying power as some Western countries, these markets are favored for their fast growth and limited domestic car industry.

Read: Existing BYD Owners Furious After Car Prices Drop And Features Get Better

According to a report from The Economist, Chinese carmakers have grown from close to zero presence to holding eight percent of the market in the Middle East and Africa, six percent in South America, and four percent in Southeast Asia – all in a few years.

China’s aggressive push into these markets stems from a slowdown in its home market. While some 23 million vehicles were sold in China last year, growth has reduced, and domestic automakers are presented with a severe overcapacity issue. It’s estimated that if Chinese car plants were to run at full capacity, they could churn out close to 45 million cars per year. Right now, output is pegged at sixty percent of that figure.

The Quest Overseas

Despite the overcapacity issue they have at home, Chinese carmakers want to stick a flag in the ground overseas, by building factories in pastures anew. Reports estimate that 2.5 million cars will be built by Chinese brands in foreign factories, allowing these companies to avoid tariffs and shipping costs. BYD is already making cars in Thailand and Uzbekistan, with plants for plants in Brazil, Indonesia, Hungary, Turkey, and possibly Mexico. They’re not alone, with Chery, Great Wall, SAIC, and Changan hatching similar plans.

It’s unclear how the Chinese government, which is already providing incentives for local brands to keep manufacturing at home, will view efforts to move manufacturing overseas. Regardless, Chinese automakers are making their Japanese and South Korean competitors nervous, as well as American and European brands that don’t welcome the added pressure.