The race to bring electric cars into the mainstream market is in full swing, but despite their best efforts, Europe’s top car companies may not be able to catch up with China after all.

China is seen as the leader in EV battery technologies, which is vital for the future of the auto industry as a whole.

Analysts predict that the Asian country will remain in the top spot in the years to come, CNN reports.

“Europe might well see its car makers massively moving production to China in the future,” said Simone Tagliapietra, an energy analyst at the Milan-based Fondazione Eni Enrico Mattei think tank. “This is a huge risk” for the European automotive industry, he added.

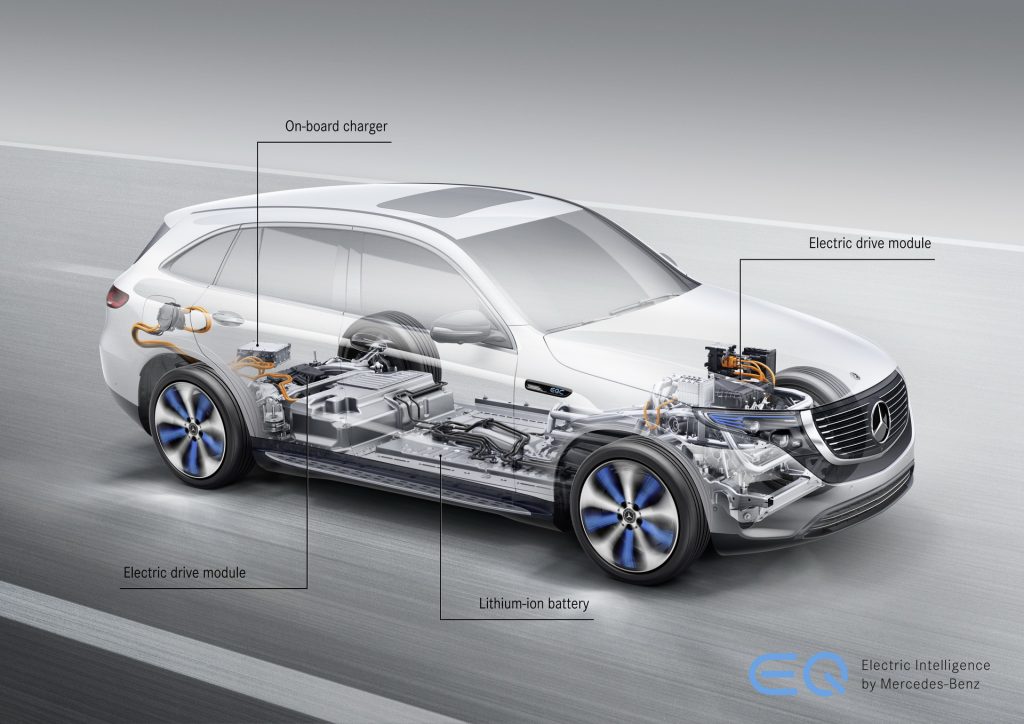

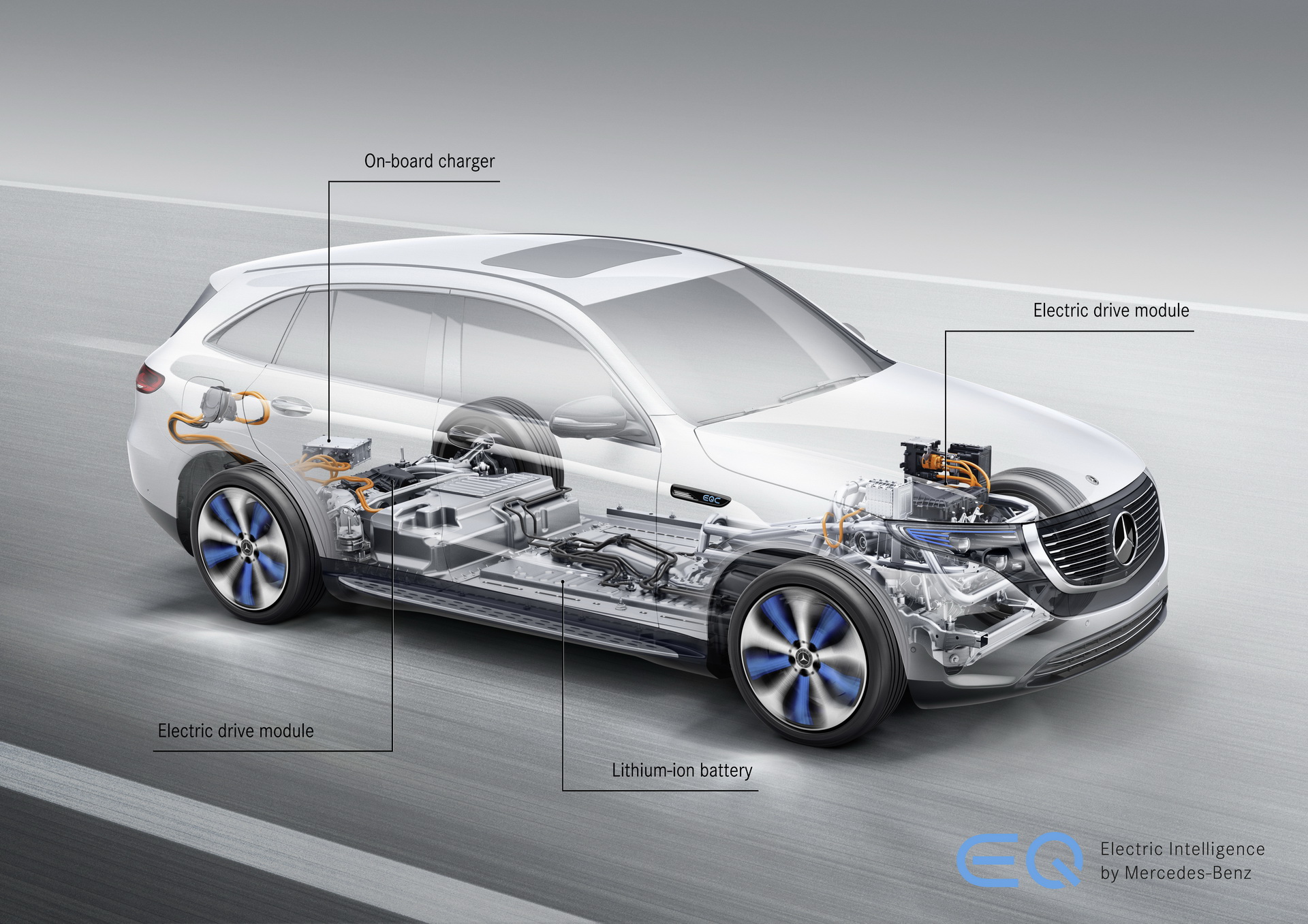

China is the largest electric car market in the world, accounting for around half of global sales, but is also where almost two-thirds of the world’s manufacturing capacity for lithium-ion batteries resides. These two factors alone play a huge part for car companies to build their electric cars there, not to mention that they avoid the heavy tariffs on imported vehicles as well.

“It just makes sense to produce electric vehicles where batteries are also produced,” Tagliapietra said.

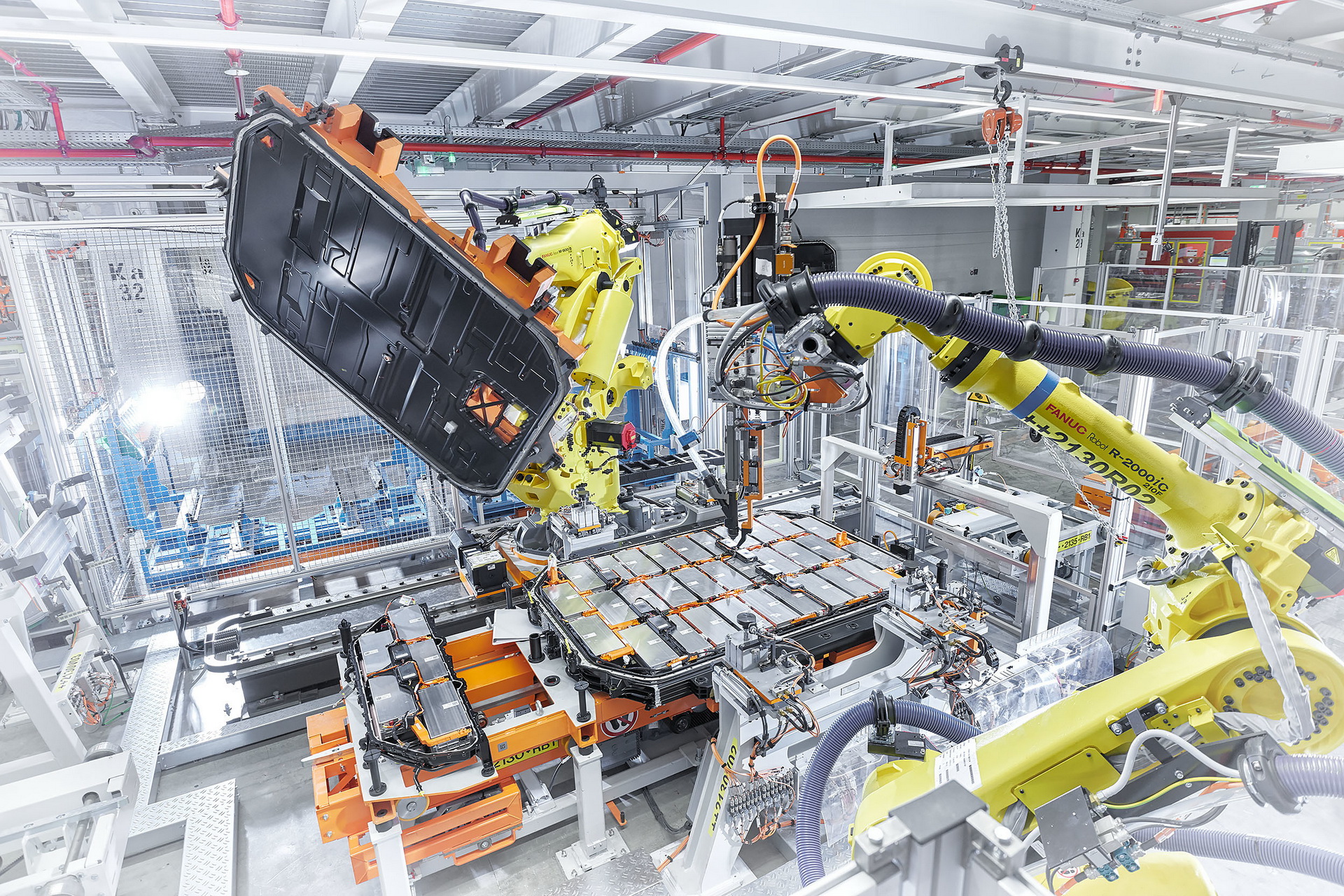

Europe, on the other hand, is estimated to have just 1 percent of the lithium-ion battery production market. “There’s a few smaller European facilities, but nothing significant,” said Gavin Montgomery, Wood Mackenzie’s research director of global metals markets in London.

But even Europe’s major battery companies are picking China to invest in, rather at home; Netherlands-based Lithium Werks already has two factories in China and prepares for a third one, a $1.8 billion investment that will be completed with a local partner outside Shanghai.

Kees Koolen, Lithium Werks’ Chairman, said that the company was investing in China because of its better infrastructure and easier access to permits needed for a factory. “In Europe there’s a lot of hassle and a lot of procedures to follow. It takes a long time,” Koolen said.

The European Commission tries to change that with a new strategy that includes encouraging companies to invest more in battery technologies, including offering more funding to them.

“The lack of European cell manufacturing base puts the EU at a competitive disadvantage – it jeopardizes the position of EU’s industry because of security of supply chain issues and increases costs due to transportation, time delays, weaker quality control or limitation on the design”, said the Commission in a press release.

Europe’s plans however could come across other issues. China has been locking down supplies of the key resources required for battery production, like lithium and cobalt, in the past few years. “It’s already too late” for European companies to establish themselves as large-scale manufacturers of lithium-ion batteries, said Viktor Irle, co-founder of Swedish research firm EV-Volumes. “That train has already departed.”