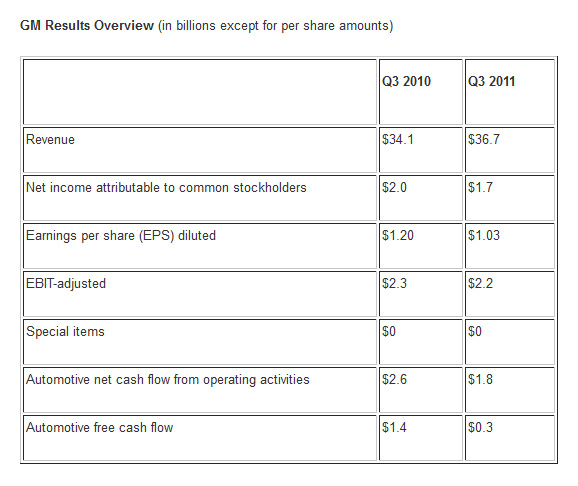

General Motors announced on Wednesday its third quarter financial results. Earnings were down 15% compared to last year, from US$2.0 to US$1.7 billion, which equates to a US$1.03 profit per share compared to 2010’s US$1.20.

The Detroit-based automaker’s earnings before interest and tax were $2.2 billion compared to last year’s $2.3 billion, despite the fact that net revenue increased by $2.6 billion compared to last year’s results, to $36.7 billion.

The company’s CEO, Dan Akerson, commented: “GM delivered a solid quarter thanks to our leadership positions in North America and China, where we have grown both sales and market share this year.”

Despite having made progress compared to 2010, GM’s European division continues to be a loss-making operation and Akerson is pushing for better results: “Solid isn’t good enough, even in a tough global economy. Our overall results underscore the work we have to do to leverage our scale and further improve our margins everywhere we do business.”

GM expects fourth quarter net income to be similar to that of 2010. Europe’s bleak economic outlook also means that the company anticipates that it won’t achieve its target to break even before restructuring charges in the Old Continent.

“GM continues to execute the plant we outlined for investors in 2010”, said senior vice president and CFO Dan Ammann.

“That includes investing in our products, further strengthening our balance sheet and generating cash and profits each quarter. The next level of performance will come as we eliminate complexity and cost throughout the organization,” he added.