It doesn’t exactly take a degree in economics to notice that used car prices are going a little nutty but the price increases are now coming for small, fuel-efficient, and otherwise cheap vehicles, according to a new study by used-car search engine iSeeCars.

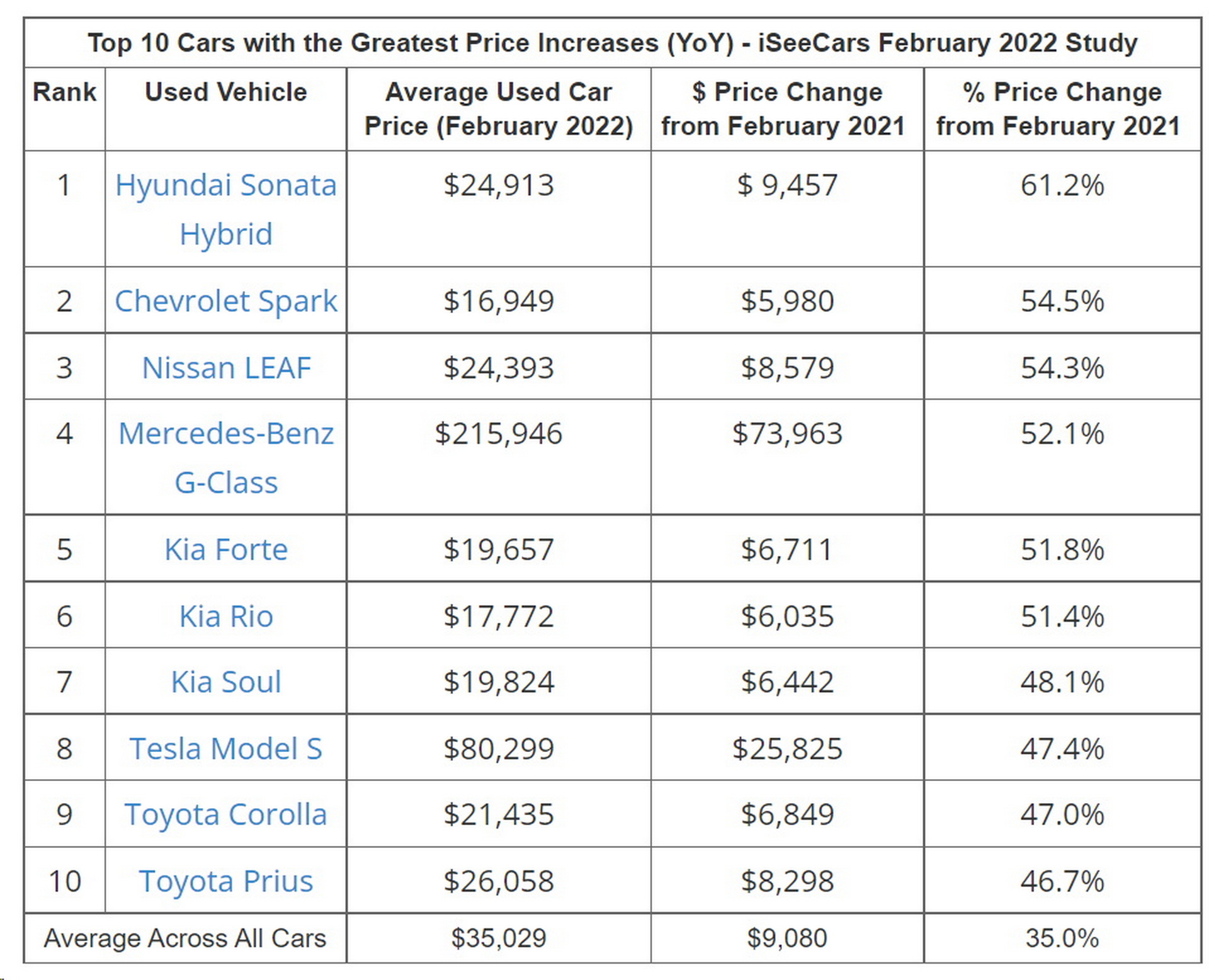

Of the 10 cars whose prices increased the most year-over-year in February, nine were either small, fuel-efficient, or fully electric. The vehicle whose price increased the most in February 2022 as compared to February 2021 was the Hyundai Sonata Hybrid. Its average price of $24,913 was $9,457, or 61.2 percent, higher than last year, according to iSeeCars data.

It was followed by the Chevrolet Spark, whose price was up 54.5 percent, and the Nissan Leaf, for which consumers paid 54.3 percent more. The Leaf wasn’t the only EV on the list, though. Used prices for the Tesla Model S rose 47.4 percent, while the Toyota Prius rose 46.7 percent. Also represented in the list are the Toyota Corolla, and the Kia Soul, Rio, and Forte.

Read Also: With Gas Prices At An All-Time High, What Are The Best Fuel Efficient Vehicles?

The one outlier in the top 10 is the Mercedes G-Class, though its rising value on the second-hand market isn’t too big of a mystery as iSeeCars’ executive analyst, Karl Brauer explained: “The wait time for a new version of the Mercedes-Benz G-Class is over a year, so buyers who want this opulent off-roader are turning to the used car marketplace.”

In terms of average prices by fuel type, hybrid vehicles have seen the greatest appreciation in the last 12 months. On average, used values for hybrids in America rose by $10,604 to $33,210, which marks a 46.9 percent increase. They were followed by EVs, for which consumers were paying 43 percent, or $16,121, more in February.

Indeed, demand for fuel-efficient (or electric) vehicles is likely to continue rising since these numbers are from February. Although Russia began its invasion of Ukraine in late February, fuel prices really started to soar in March.

The rising prices of small cars also point to the fact that, as all used cars appreciate, consumers are just looking for something affordable. As supply lines are affected by sanctions and new waves of the COVID-19 pandemic affect production, the conditions that led to the spike in used car values don’t seem to be disappearing.