Thanks to shortages, inflation, and massive dealer markups, car buying is the new Wild West.

Given those rampant issues, it’s not surprising that some shoppers are pumping the brakes and rethinking the need to buy new.

According to July insights from GfK AutoMobility, 57% of consumers have no intention of buying a new vehicle. That’s the highest level since 2016 and the report notes some of the most important demographics are turning away from new cars.

Also Read: Study Finds 25% Of Car Buyers Won’t Return To Dealership That Charged Above MSRP

Among likely Gen Y and Gen X buyers, who are between the ages of 25-42 and 43-57, only 37% plan to purchase a new vehicle in the next two years. That’s down 8% from July of 2020 and GfK AutoMobility noted the “levels are similar for those intending to get a new or used vehicle in the next 3 months, 6 months, or 1 year.”

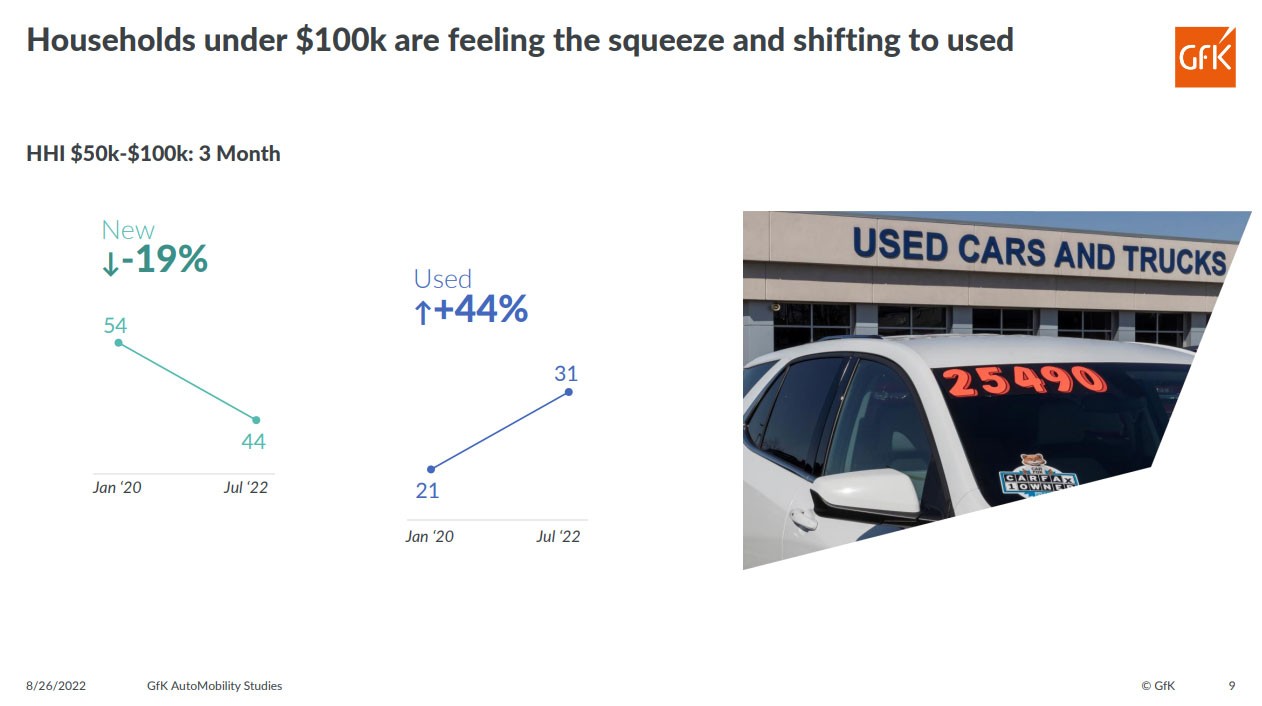

Interestingly, both moderate and high income consumers are turning away from new cars. For 3-month intenders earning between $50,000 and $100,000 annually, only 44% are planning to get a new vehicle and that’s a 10% drop from 2020. This is matched by a 10% increase in intenders looking to buy used.

Households earning $150,000 or more are also showing less interest in new cars as only 72% of 3-month intenders are expecting to purchase a new vehicle. While that’s significantly higher than lower income brackets, it’s still a 5% drop since January of this year.

Furthermore, 21% of 3-month intenders earning between $100,000 and $150,000 are looking exclusively at used cars. Another 19% are considering new and used vehicles equally.

The report also notes the mood of consumers is gloomy as only 21% think it’s a good time to buy a vehicle. Those levels haven’t been seen since the Great Recession and a majority of consumers think it’s a good time to wait.

That isn’t the only flashing warning light for the automotive industry as intenders are even turning away from full-size pickups (FSP) – both short and long term. Gfk AutoMobility noted this “represents the first about-face in the seemingly unstoppable growth of FSPs over the past 2 years.”

GfK AutoMobility Senior Vice President Julie Kenar noted, “Consumers buying new cars is the life blood of the auto industry” but “intenders can only tolerate so many headwinds – gas prices, inflation, and the highest prices for a new car that the industry has ever seen.”