If you’ve been shopping for a new car lately, you’ve likely had sticker shock.

While inflation and low inventories have already been conspiring to raise prices, rising interest rates are creating a one-two punch of pain.

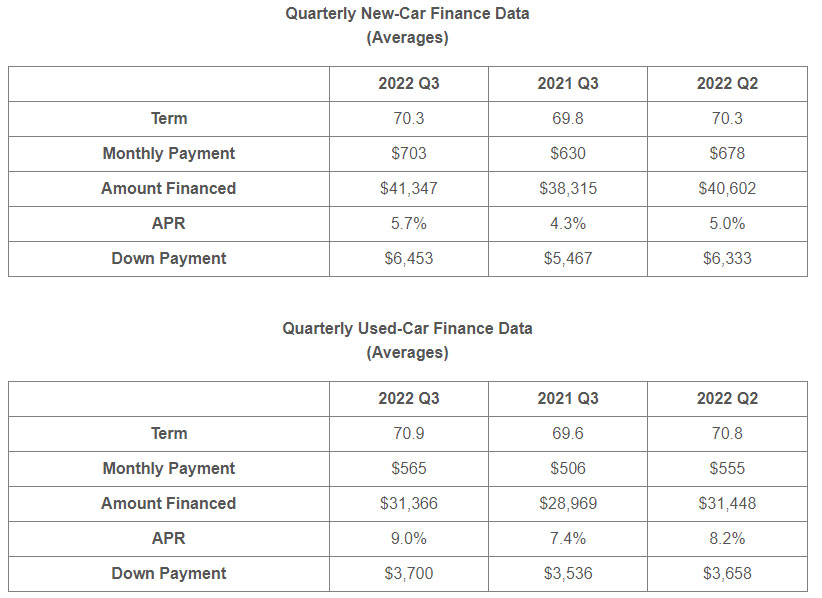

According to a new study from Edmunds, the average annual percentage rate (APR) on new financed vehicles was 5.7% in the third quarter. Those are the highest rates since 2019 and it’s even worse when you consider the average amount financed hit an all-time record of $41,347.

Also Read: Looking To Save? These Are The 10 Most Discounted New Cars And SUVs On The Market

As a result, buyers are facing large monthly payments which averaged over $700 per month in the third quarter. However, that’s cheap compared to the 14.3% of consumers who financed a new vehicle with a monthly payment of at least $1,000. That rate is the highest Edmunds has on record and just 8.3% of monthly payments were $1,000 or more in the third quarter of 2021.

While traditional incentives have largely fallen by the wayside, a number of automakers have been offering low interest rates to entice consumers. People seem to be responding as Edmunds found a “small uptick in shorter loan terms in Q3.”

These offers might be the way to go as the company “calculated how much additional interest a consumer could expect to pay on a $40,000 car loan for 72 months at 5% APR versus 36 months at 1.9% APR.” While the shorter term loan would increase the payment from $644 to $1,144 per month, consumers would save a whopping $5,200 in interest. That being said, not everyone can afford an extra $500 a month for their car payment.

Speaking of shoppers with smaller budgets, buying used has perils of its own. Edmunds found that the average APR for used cars in the third quarter was 9.0% and consumers were financing an average of $31,366. That results in a monthly payment of $565.

Getting back to new cars, 26% of EV buyers in the third quarter were paying a $1,000+ per month. That compares to 24% for plug-in hybrids, 14% for traditional ICE models, and 4% for hybrids.

The brands with the highest share of customers paying a $1,000+ per month were unsurprisingly premium automakers such as Porsche (72%), Land Rover (66%) and Jaguar (51%). However, GMC and Ram cracked the top ten list thanks to pricey pickups.

Edmunds’ executive director of insights, Jessica Caldwell, said “Despite worrisome macroeconomic conditions, Americans are spending more money than ever on new vehicle purchases.” She added, “Rising interest rates combined with higher prices has sent monthly payments soaring to new heights.”