Used car retail giant CarMax reported their third quarter results and they’re providing some alarming insights into the used car market.

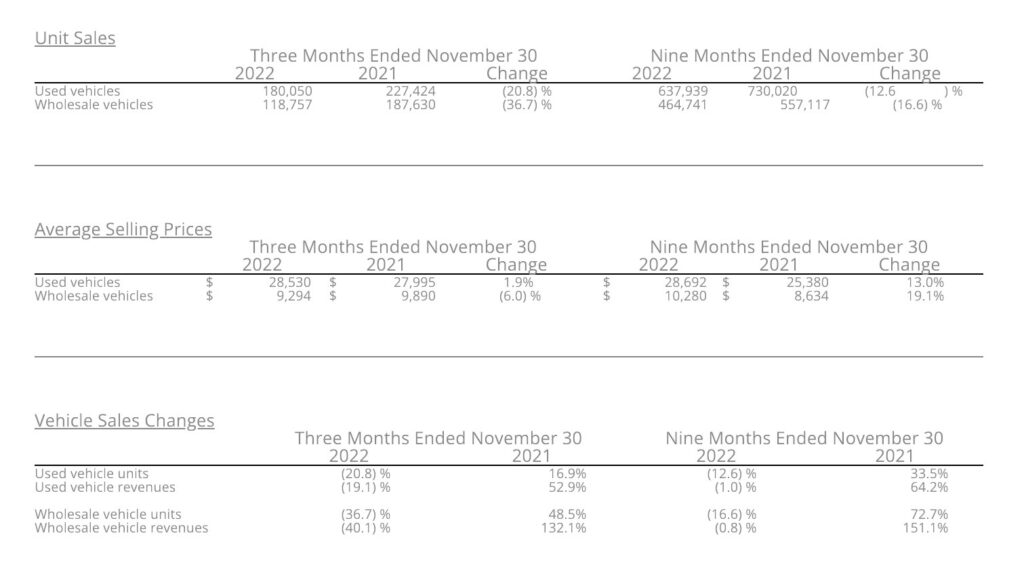

Most notably, sales fell significantly as the company reported a 20.8% decline in retail sales as well as a 36.7% decrease in wholesale sales. The latter figure came despite a $165 price drop per unit and it seems even lower prices aren’t enticing wholesale buyers.

CarMax sold 298,807 used vehicles in the third quarter and that’s a 28% drop from a year ago. The company chalked the declined in retail sales up to “affordability challenges” as well as headwinds from “widespread inflationary pressures, climbing interest rates, and low consumer confidence.”

Also: Thinking Of Selling Your Vehicle To CarMax, Carvana Or Vroom? Here’s Who Will Pay You The Most

While used car prices have started to fall, vehicles are far from affordable thanks to sky-high interest rates. U.S. News & World Report says consumers with a credit score of 750 or higher can expect to get a used car loan with a rate of 8.85%. That climbs to 9.92% for people with credit scores of 700-749, and a whopping 15.05% for those with scores between 600-699. Consumers with scores below 600 can expect interest rates in excess of 20%, assuming they get approved in the first place.

Getting back to CarMax, the decline on the wholesale side was blamed on “rapidly changing market conditions and retail selectivity.” The company also noted they decided to shift some wholesale units to retail units in order to meet growing demand for more affordable vehicles.

CarMax cut back on buying as they only purchased 238,000 vehicles from consumers and dealers, which is down 39.8% from a year ago. The company says this was deliberate and noted there’s “steep market depreciation,” which makes purchasing vehicles risky as they could lose value or become less profitable.

Thanks to the drop in sales, CarMax posted net revenues of $6.5 (£5.4 / €6.1) billion. That’s down 23.7% compared to the third quarter of last year and the company announced they’re pausing share repurchases “given third quarter performance and continued market uncertainties.”