2022 is coming to a close and it’s shaping up to be a year automakers would like to forget as sales are expected to be the worst in over a decade.

While the final numbers should be out early next year, Cox Automotive estimates that automakers will have sold nearly 13.9 million vehicles in the United States. If that number pans out, it would be an 8% drop from 2021 and a roughly 4.8% decline from 2020, when the economy ground to a halt due to the COVID-19 pandemic. Even more telling, it would be the worst result since 2011.

Cox notes 2022 was a year of challenges as it began with supply chain problems and the continuing chip crisis. Things got worse from there as interest rates soared as the Federal Reserve sought to keep inflation in check. This has had a devastating impact as Cox noted auto loan costs have increased to “levels not seen in more than 20 years, pushing some shoppers out of the market due to vehicle affordability concerns.”

Also: Average Monthly Car Payments Reach Record High Of $712

The effect can be seen in the sales chart as Cox noted the sales pace declined by nearly 2 million units since October. This was despite increasing inventories and senior economist Charles Chesbrough stated, “Given the large improvement in supply levels, it seems likely that rising interest rates are now constraining demand in the retail auto market.” He added that “With record-high prices and elevated loan rates, the pool of potential new-vehicle buyers is shrinking.”

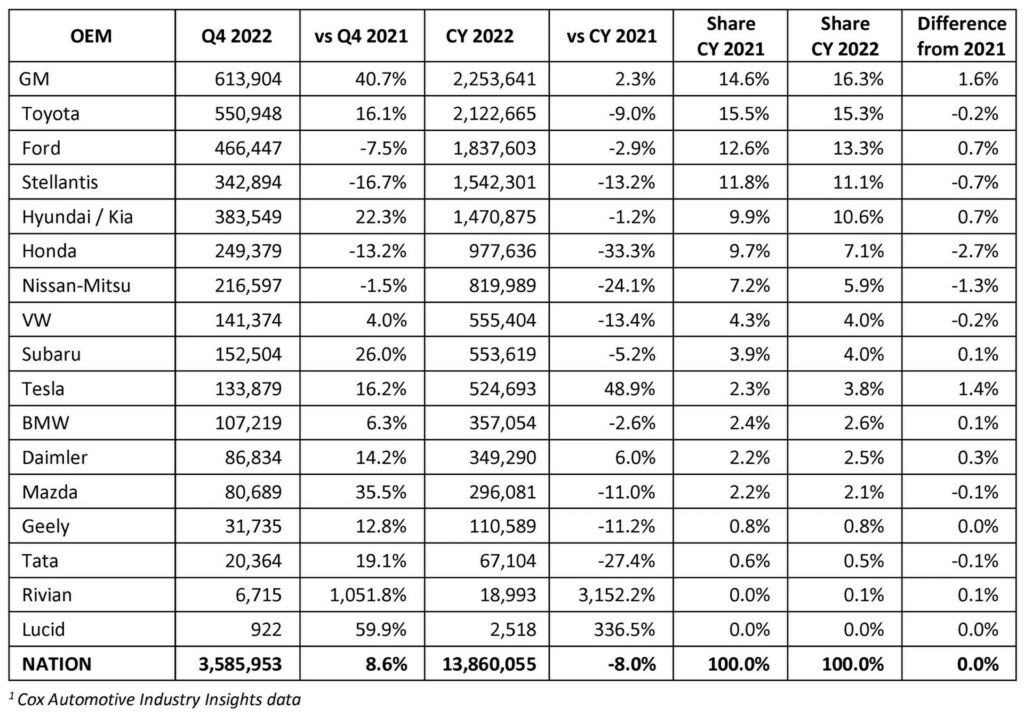

GM is expected to become America’s best-selling automaker as Cox estimates they will sell 2,253,641 units this year. That would put them nearly 131,000 units ahead of Toyota, which is expected to suffer a 9% drop in sales.

Ford is slated to finish third with around 1,837,603 units, while Stellantis and Hyundai / Kia round out the top five spots. Tesla looks like the big winner with a projected 48.9% increase in sales, while Honda is expected to falter with a 33.3% drop.

While 2022 was a rough year for automakers and consumers alike, 2023 isn’t looking much better as Cox expects vehicle affordability will continue to be an issue. That being said, they’re expecting a modest sales increase compared to 2022.