Sales of Stellantis-owned carmakers fell considerably in the United States last year but there is one piece of good news for the automotive conglomerate: the average transaction price of its new vehicles jumped.

Stellantis’ recent publication of its full-year 2022 results reveals that its Q4 sales in the U.S. fell by 15.5 per cent from Q4 2021 to 347,649 units. That sales figure is a particularly significant drop from a high of 542,519 sales reported in Q4 2019, just prior to the COVID-19 pandemic.

Most Stellantis brands experienced a fall in sales. Indeed, Jeep sales dropped by 18 per cent to 143,317 vehicles, Ram sales fell by 14.5 per cent to 129,873 units, Chrysler sales fell of a cliff by 39 per cent to 25,052 sales, Alfa Romeo sold 25 per cent fewer vehicles in the last quarter totaling 3,031 units, and Fiat’s sales fell by 56 per cent to just 118 units. The only brand that experienced a jump in sales was Dodge, selling 46,278 vehicles, a 15 per cent increase.

Read: Stellantis To Confirm New Models For Windsor Plant By Q3, Likely Includes Charger EV

The sales decline came as Stellantis significantly slashed incentives for all of its brands, dropping incentive spending by 31 per cent in Q4 2022 compared to the previous year.

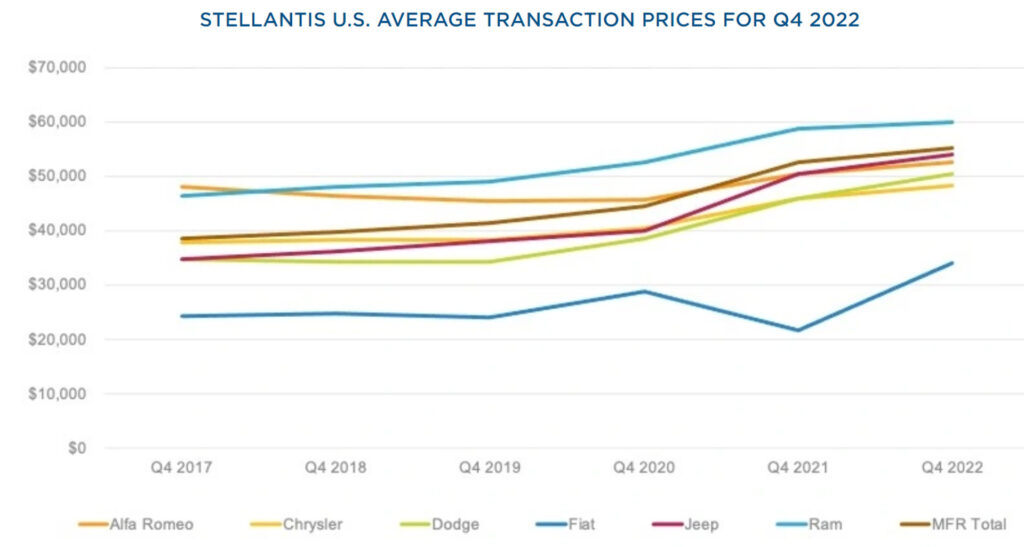

While the brand’s sales took a hit, the average transaction prices of its vehicles swelled by 5 per cent last year, topping out at $55,281, Cox Automotive notes.

Ram models typically sell for the most with an average transaction price of $59,903. The ATP of Jeep models jumped by 7 per cent to $53,968 thanks in part to the introduction of the Wagoneer and the Grand Wagoneer. The average Dodge ATP also climbed by 9.5 per cent to $50,369 with prices of the Charger jumping by a considerable 13 per cent to $47,118. The most expensive Dodge model was the Durango with an average transaction price of $53,431, a 4 per cent increase.