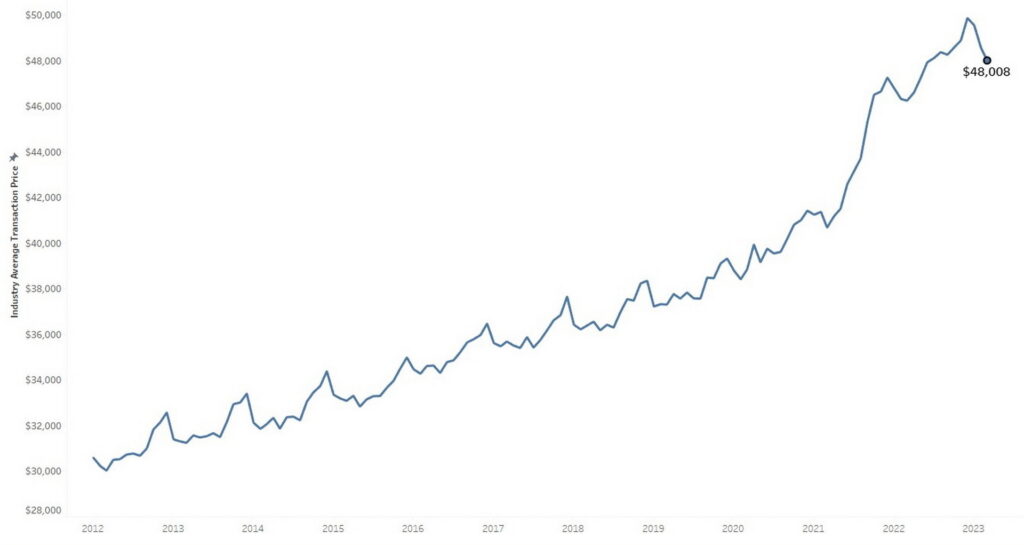

March of 2023 marks the first month in which Americans paid less than MSRP on average for a new car since the summer of 2021. While prices are higher than they were a year ago, a number of statistics point to better deals for consumers. Here’s a breakdown of the latest figures.

In March, the average new car price ended up being $171 below sticker or MSRP. It’s not much but it’s movement in the right direction for a market that’s largely taken advantage of customers due to low demand and supply chain issues. Now that supply is ramping up, prices are declining.

“The latest transaction data from March reveals new-vehicle prices continued a downward trend through the first quarter of 2023,” said Rebecca Rydzewski, research manager of economic and industry insights for Cox Automotive.

Average New Car Transaction Prices By Brand

“Both luxury and non-luxury prices were down month over month. We’ve been anticipating transaction price declines as inventory has steadily improved and choice has expanded. More vehicles on dealer lots – and on their competitors’ lots – means dealers simply don’t have the pricing power they did six months ago,” she continued.

Last March, the average transaction price (ATP) was almost $1,000 over MSRP. Breaking down different segments gives us a better idea of where the savings are. Non-luxury cars saw the biggest drop with an average decline of $505 when compared to February of this year.

That drop is correlated directly with increased sales incentives across these brands. Two non-luxury brands, Kia and Honda, each bucked the trend though registering ATPs of six and three percent respectively.

Luxury Cars Continue To Command A Premium

Unsurprisingly, those willing to shell out the big bucks for luxury vehicles are also willing to pay above MSRP for them. Porsche and Land Rover now have ATPs of six figures or more. During March, the average transaction price across all luxury brands (exotic brands like Ferrari and Lamborghini are excluded) was $65,202.

EVs Tick Upward

Electric vehicles saw a slight bump in average price during March. That’s might seem counterintuitive considering the numerous price cuts enacted by Tesla, the EV sales king. But increased EV sales from other brands picked up the entire segment. Up $313 on average or about .5 percent over February, EVs continue to sell for well above the industry average.

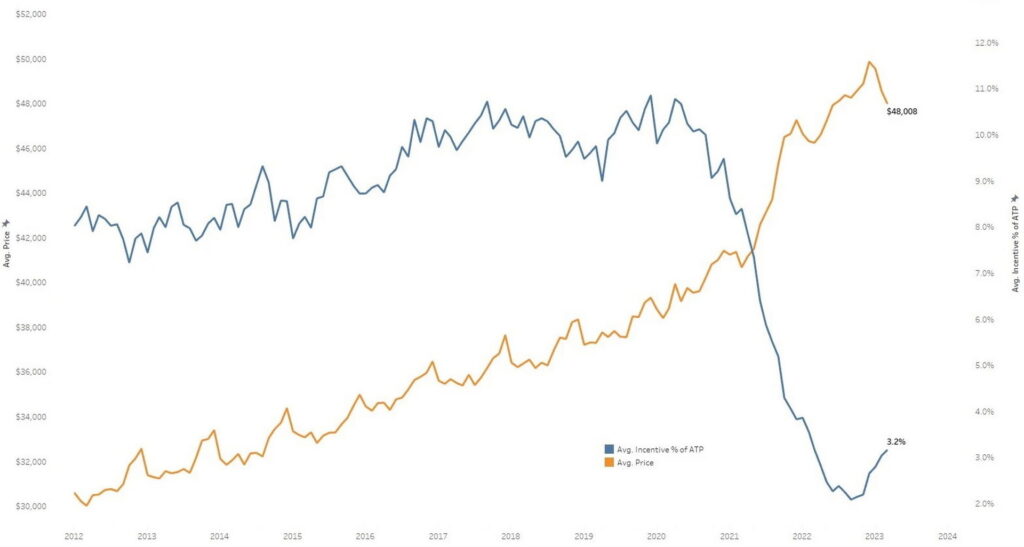

Incentives Drive Down Pricing

Across the automotive landscape, automakers haven’t really been offering the big-time incentives that they did years ago. In March of 2021, incentives averaged about 8.4 percent of the average transaction price. In February of 2023, that number was just 3 percent. Last month it jumped a little bit to 3.2 percent. According to Rydzewski, that’s in harmony with increased inventory.

“Incentives and inventory tend to move in tandem – when one moves up, so does the other,” said Rydzewski. “Right now, in-market consumers are finding more inventory, more choice, and dealers more willing to deal, at least with some brands. Yet, even as deals improve, unfortunately, auto loan rates remain very high, ultimately making new-vehicle affordability an issue for many households.”

Average New Car Transaction Prices By Category