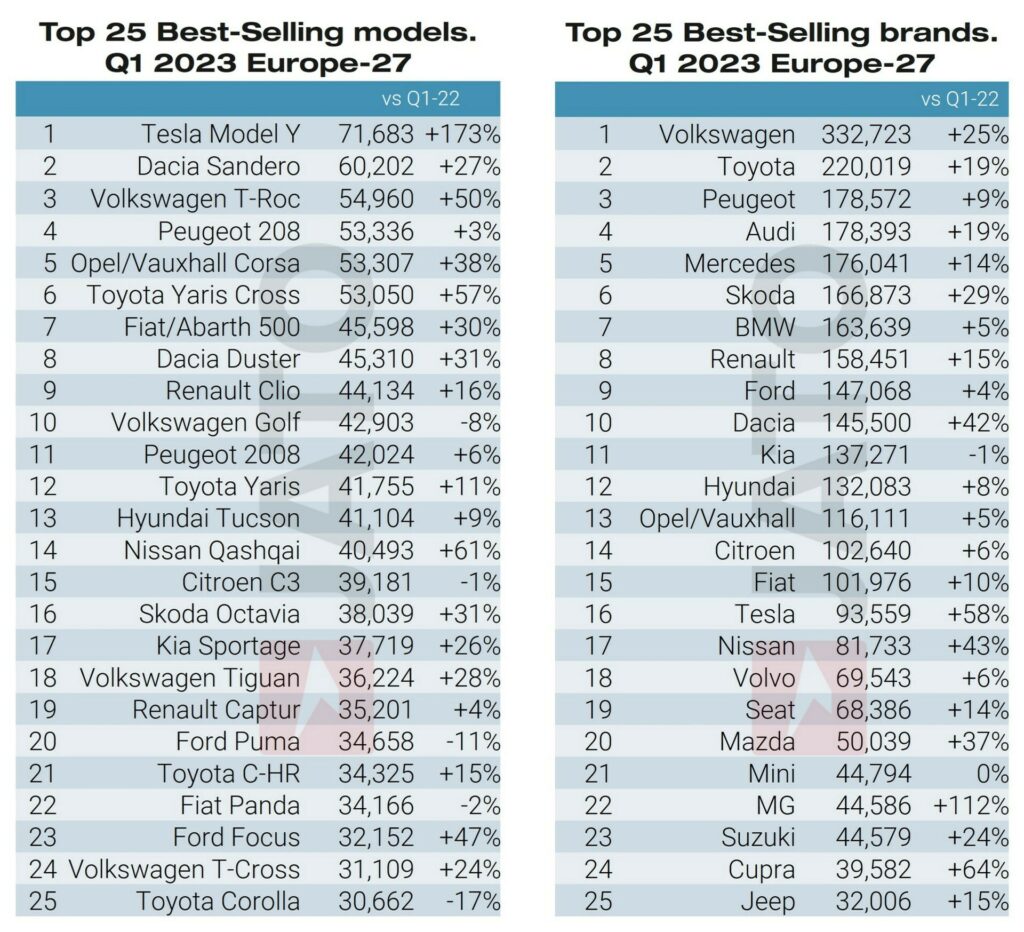

The Tesla Model Y is officially the best-selling car in Europe for the first quarter of 2023, showing an impressive 179% increase in sales compared to the same period last year. The electric SUV outsold both the Dacia Sandero and the Peugeot 208 superminis which completed the top three spots across 27 European markets. Volkswagen was the best-selling brand overall, finishing ahead of Toyota and Peugeot.

According to JATO, the Tesla Model Y topped the ranking in March 2023, repeating the feast of September and November 2022. However, this is the first time it wins the top spot on a quarterly basis. Indicative of the increase in Model Y registrations in Europe is that the EV occupied the 31st position in Q1 2022, jumping a massive 30 spots in a single year.

Read: Tesla Cuts EV Prices In Europe, Singapore, And Israel

Felipe Munoz, Global Analyst at JATO Dynamics justifies the sales success to the “increase in production alongside fewer supply chain issues”, suggesting that the Model Y will likely be among Europe’s top-5 best-selling vehicles in 2023 overall. On the other hand, sales of the closely-related Tesla Model 3 dropped by 40% in Q1 2023, proving once more that buyers prefer SUVs. Tesla is working on a facelifted Model 3, with a similarly updated Model Y rumored for next year.

New car registrations in Europe showed a 17% increase in Q1 2023, totaling 3,220,806 units which is the highest number since 2019 (pre-covid). According to Munoz, the increase is “largely explained by accumulated orders from previous months that could not be delivered due to the lack of components at the time”.

Growing Demand For BEVs

Fully electric cars accounted for 13.4% of the total new car registrations in Europe in Q1 2023, with 430,700 units. This was the highest-ever first-quarter performance for BEVs, attributed to the larger number of options, the more affordable prices, and the appealing incentives.

Tesla got the largest piece of the pie with a 22% share in BEV registrations, topping the previous year’s record. VW Group occupied second place in the BEV ranking by a small margin, despite surpassing Tesla’s growth in March and having the ID.3 and the ID.4 in the 3rd and 4th place of the rankings respectively.

Other EV-makers with good results in this period were Geely and SAIC (MG), showing that this is only the beginning of Chinese automakers’ offensive to the Old Continent. Another interesting fact is that the Toyota bZ4X which is currently the only fully electric offering in the Japanese brand’s European range showed a massive sales increase of 437% in the first quarter, but failed to enter the top 10 with only 3,700 registrations.