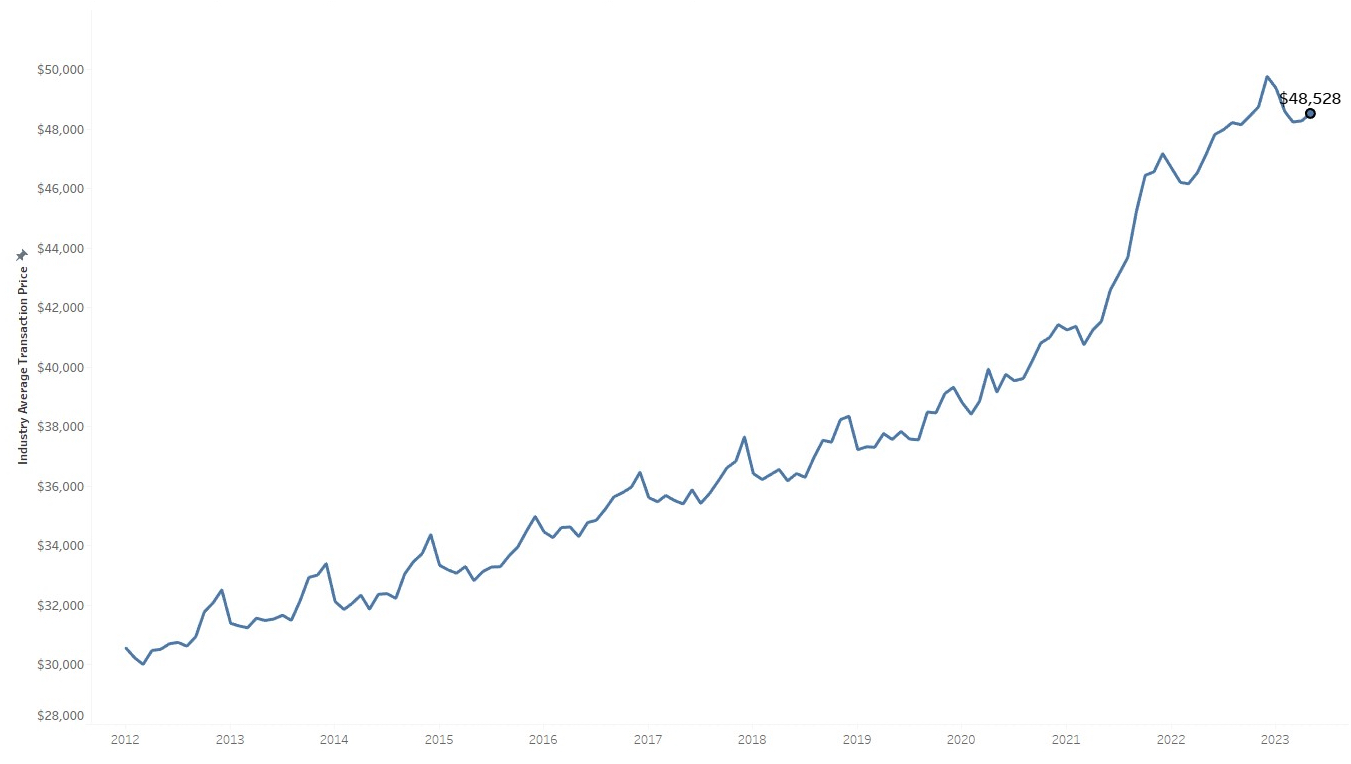

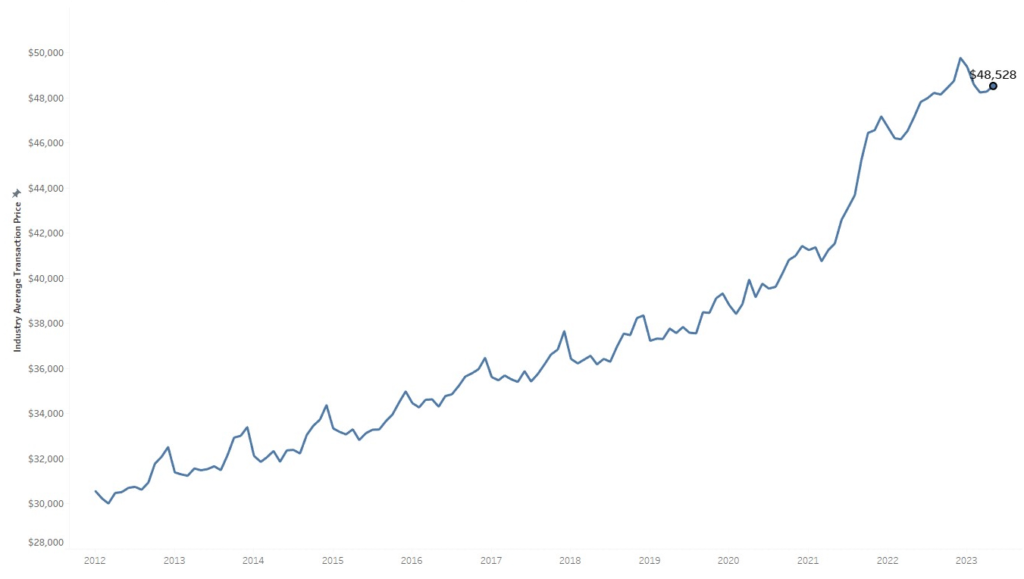

The average transaction price for a new vehicle sold in the United States jumped slightly in May but for the fifth consecutive month, consumers continued to pay less than the manufacturer’s suggested retail price.

An analysis from Kelley Blue Book has revealed that last month, consumers on average paid $410 below the advertised sticker price. This contrasts to May 2022 when the average ATP was some $637 above MSRP.

However, the average transaction price of a new vehicle in the U.S. rose by 0.5% ($251) over April 2023 to hit $48,528. This represents a 3% ($1,393) increased over May 2022 and despite the rising prices, sales volumes in May were up month over month by 0.7% and 22.1% year over year. This came in part due to higher inventory levels and a “healthy dose of fleet deliveries.”

“The modest new-vehicle price increase in May was offset by increased incentives, so many buyers were able to find deals below sticker,” Cox Automotive’s Rebecca Rydzewski said. “This is good news for consumers as manufacturers are seeing higher inventory and increased competition and need to push sales to keep inventory moving.”

Read: Average New Car Transaction Prices Drop Below MSRP For The First Time In Nearly 2 Years

Consumers shopping in the non-luxury segment spent an average of $44,960, a $158 increase compared to April and a 3.7% rise year over year. Meanwhile, the average luxury buyer paid $64,396 for a new vehicle in May 2023. This represented a $239 increase from April this year. Kelley Blue Book notes that demand for luxury vehicles remains the primary reason for elevated new-vehicle prices, accounting for 18.4% of total sales.

In terms of EVs, the average price paid in May was $55,488. This is down a considerable 14% or $9,370 compared to one year ago.

“When it comes to EVs, automakers are trying to find a balance between pricing and profitability,” Cox Automotive executive analyst Michelle Krebs noted. “EV sales in May are estimated to have increased by 4.7% compared to April and are up 44% year over year. This may be due to a combination of tax credits and manufacturer incentives that are encouraging sales.”