Stellantis is set to spend $11.2 billion in semiconductors through 2030 and believes that while the current chip shortage has eased, future shortages remain a possibility.

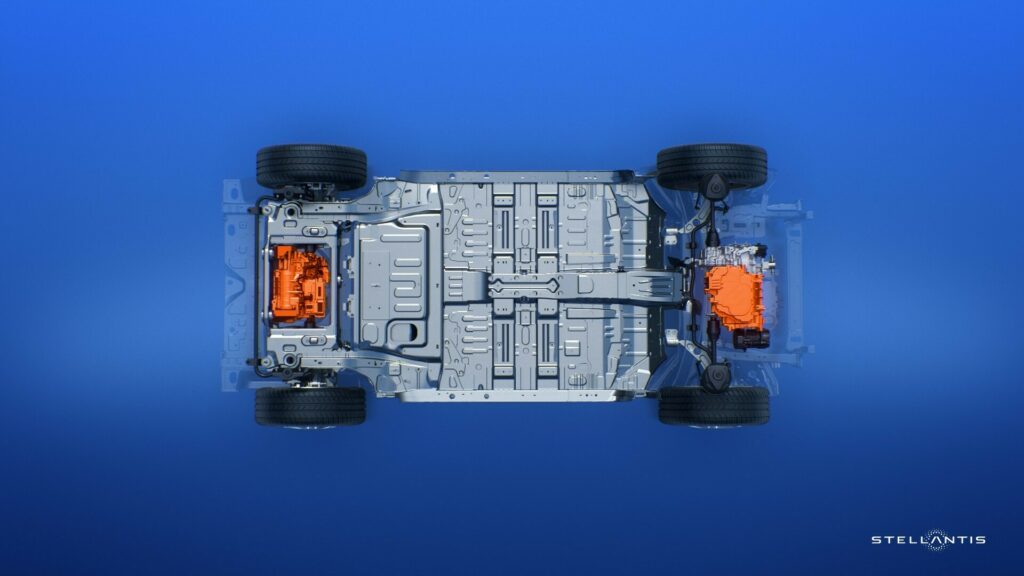

The automotive conglomerate is spending an enormous sum to secure supplies for a variety of different chips for its vehicles. These include Silicon Carbide MOSFETS that are vital to the range of EVs, Microcontroller Units (MCUs), a core component of the computing zones for the firm’s STLA Brain electrical architecture, and System-on-a-Chip (SoC) where performance is needed for a vehicle’s infotainment and autonomous driving assist functions.

To mitigate risks of future shortages, Stellantis has inked deals with Infineon Technologies, NXP Semiconductors, and Qualcomm. The company is also establishing a semiconductor database known as Green List to reduce chip diversity and in the case of future chip shortages, to put Stellantis in control of the allocation. In addition to sourcing chips from third parties, Stellantis is working with SiliconAuto and AiMotive to develop its own semiconductors.

Read: Study Says The Auto Industry’s Semiconductor Shortage Is Almost Over

“An effective semiconductor strategy requires a deep understanding of semiconductors and the semiconductor industry,” chief purchasing and supply chain officer at Stellantis, Maxime Picat, said. “We have hundreds of very different semiconductors in our cars. We have built a comprehensive ecosystem to mitigate the risk that one missing chip can stop our lines. At the same time, key vehicle capabilities directly depend on the innovation and performance of single devices. SiC MOSFETS extend the range of our electric vehicles while the computation performance of a leading-edge SoC is essential for the customer experience and safety.”

Speaking with Auto News, the man who oversees semiconductor purchases for Stellantis, Joachim Kahmann, said the risk of a chip shortage “will increase dramatically” over the coming years due to the growing array of vehicle software features. He added that rising tensions with China are an important factor to consider but did say that China’s restriction on the exports of gallium and germanium used in semiconductors should be manageable.