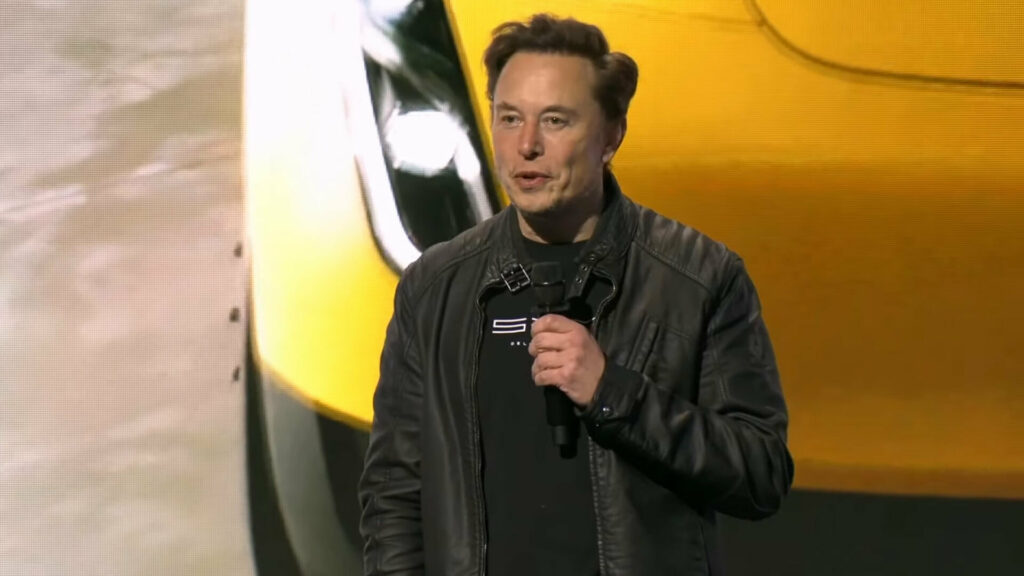

Tesla’s CEO Elon Musk revealed his thinking behind price cuts during the brand’s second-quarter earnings call. He laid the blame for decreased margin on the economy and called the current situation “turbulent times” that could lead to more cuts in the future. So far, his strategy is proving successful even if he’s uncertain of the future.

Tesla’s direct-to-consumer sales model allows it to completely control the price of its products and it’s demonstrated that over and over again this year. To date it’s changed pricing, often dropping those prices by thousands of dollars, almost ten times this year alone. Why so much fluctuation? It might have something to do with how Elon Musk views the future.

On that Q2 earnings call he said that “One day, it seems like the world economy is falling apart, next day, it’s fine. I don’t know what the hell is going on.” He went on to say that “We’re in, I would call it, turbulent times.” As a result, we expect pricing to continue its rollercoaster-esque behavior throughout the rest of 2023.

More: See The Early Designs Of The Tesla Cybertruck That Didn’t Make The Cut

Musk pointed to the fact that Federal interest rates rose as a reason for Tesla’s price cuts up to this point saying “we had to do something about that. Buying a new car is a big decision for the vast majority of people, so any time there’s economic uncertainty, people generally pause on new-car buying at least to see what happens.”

So far, his strategy has worked out just fine. Tesla continues to set new records when it comes to sales and deliveries and its stock price is up almost 140 percent this year. “I think it makes… it does make sense to sacrifice margins in favor of making more vehicles,” said Musk.

At the same time, that might not work forever. For now, Tesla still boasts margins of above 17 percent but that’s down from 26 percent a year ago. The once gigantic lead it had on other mainstream brands in terms of gross margin may end up a sacrifice on the altar of more volume.