For the first time in its 28-year history, the industry-wide score in the J.D. Power Automotive Performance, Execution, and Layout (APEAL) study has fallen for a second year in a row. The average industry score is 845 out of 1,000 in 2023, down two points from 2022, and three points from 2021.

“The decline in consecutive years might look small, but it’s an indicator that larger issues may lie under the surface,” said Frank Hanley, senior director of auto benchmarking at J.D. Power. “This downward trajectory of satisfaction should be a warning sign to manufacturers that they need to better understand what owners really want in their new vehicles.”

The APEAL study focuses on 10 factors that attempt to paint a picture of how emotionally appealing brands and vehicles are to consumers. In 2023, the industry average score was down in nine of the categories. Fuel efficiency was the only area where the average score improved (up 15 points), while exterior design was the category with the single largest decline this year, falling by six points.

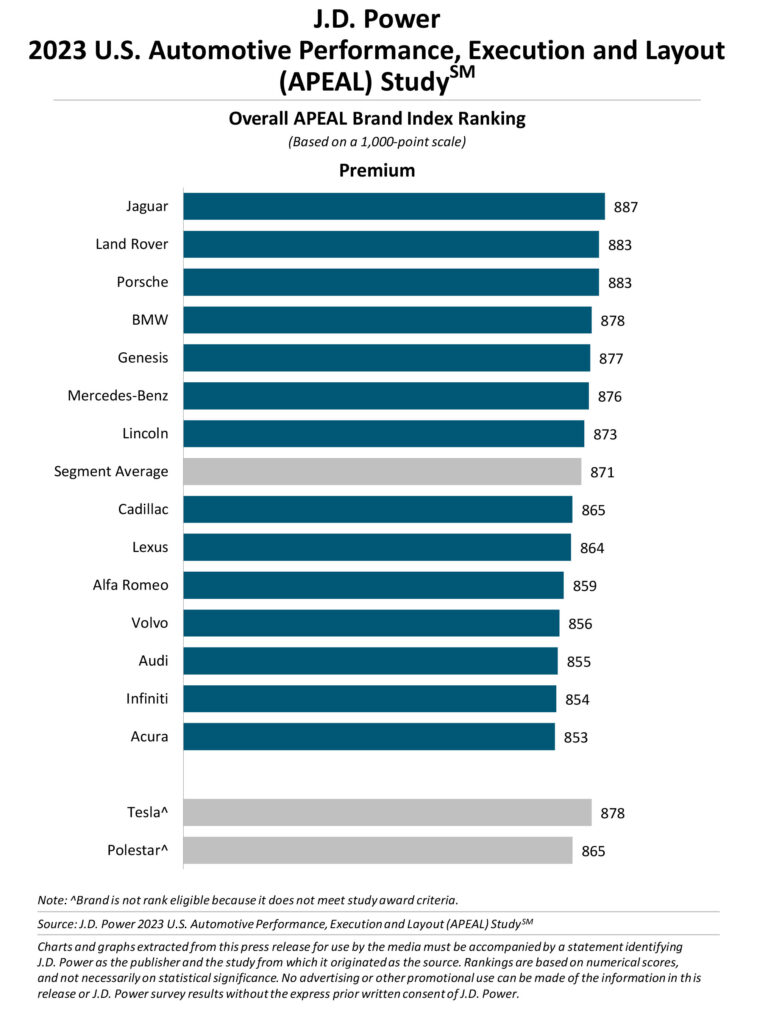

New vehicle buyers were dissatisfied in both the mass market and premium segments, and the average scores fell in both categories. Whereas the average fell by just one point among premium vehicles, it declined by four points for mass market brands, widening the gap in overall satisfaction to 34 points.

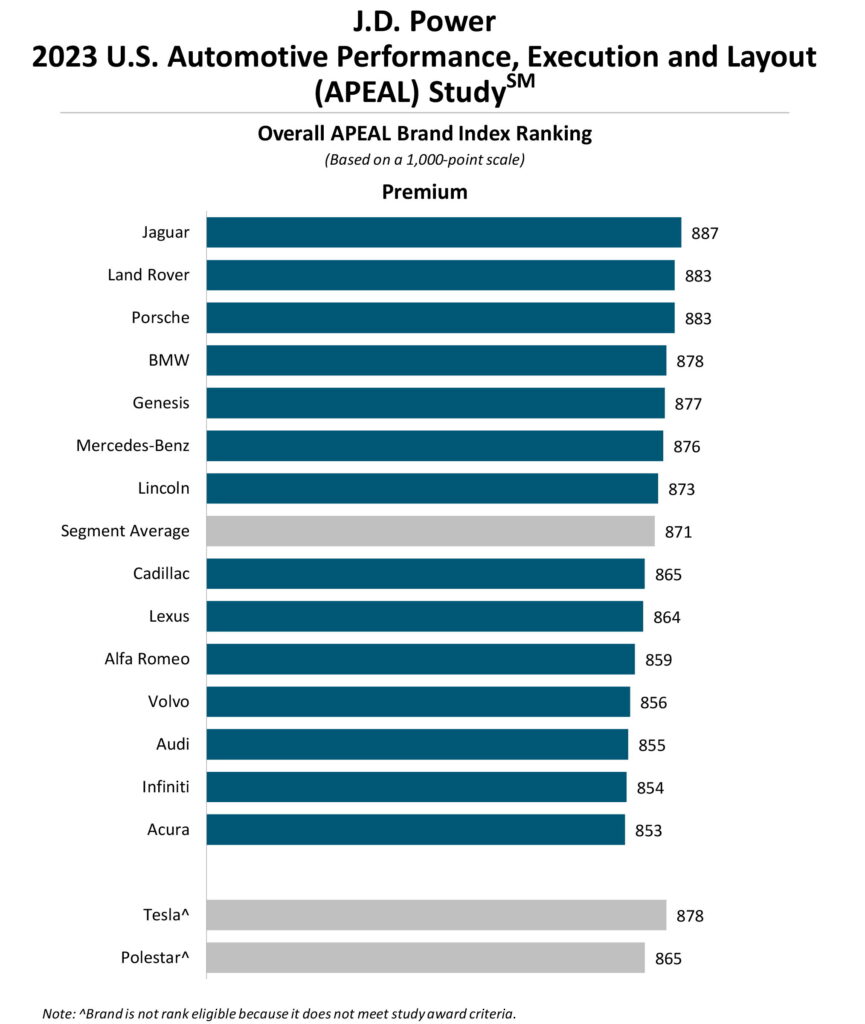

Leading the way among premium brands was Jaguar, with an overall score of 887. However, the Dodge brand punched above its weight, topping the mass market segment with an identical score of 887.

Rounding out the top five in the premium segment were Land Rover (883), Porsche (883), BMW (878), and Genesis (877). Meanwhile, the mass market segment’s leaders were Ram (873), GMC (858), Mini (856), and Kia (851). On the other end of the spectrum, Acura (853) was the worst-performing premium brand, while Chrysler was the worst-performing brand overall with a score of just 810.

Widening the scope, electrified vehicles are starting to appeal more to consumers. While internal combustion engine vehicles still rate higher (843) than their newfangled competitors, plug-in hybrid (843) vehicles are now tied with them, while EVs (Tesla excluded) are catching up and scored 840 points in 2023. Although Tesla owners are still notable for their satisfaction with their vehicles (878), that number has taken a significant hit this year, and is down nine points from 2022.

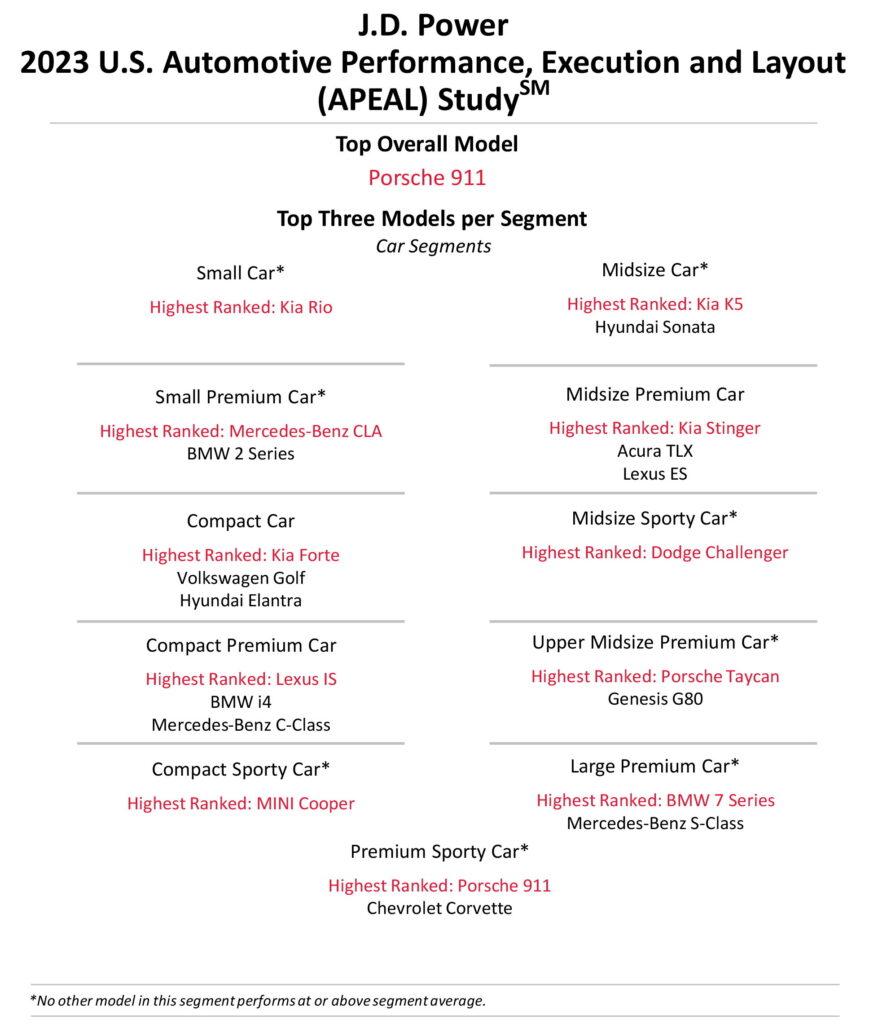

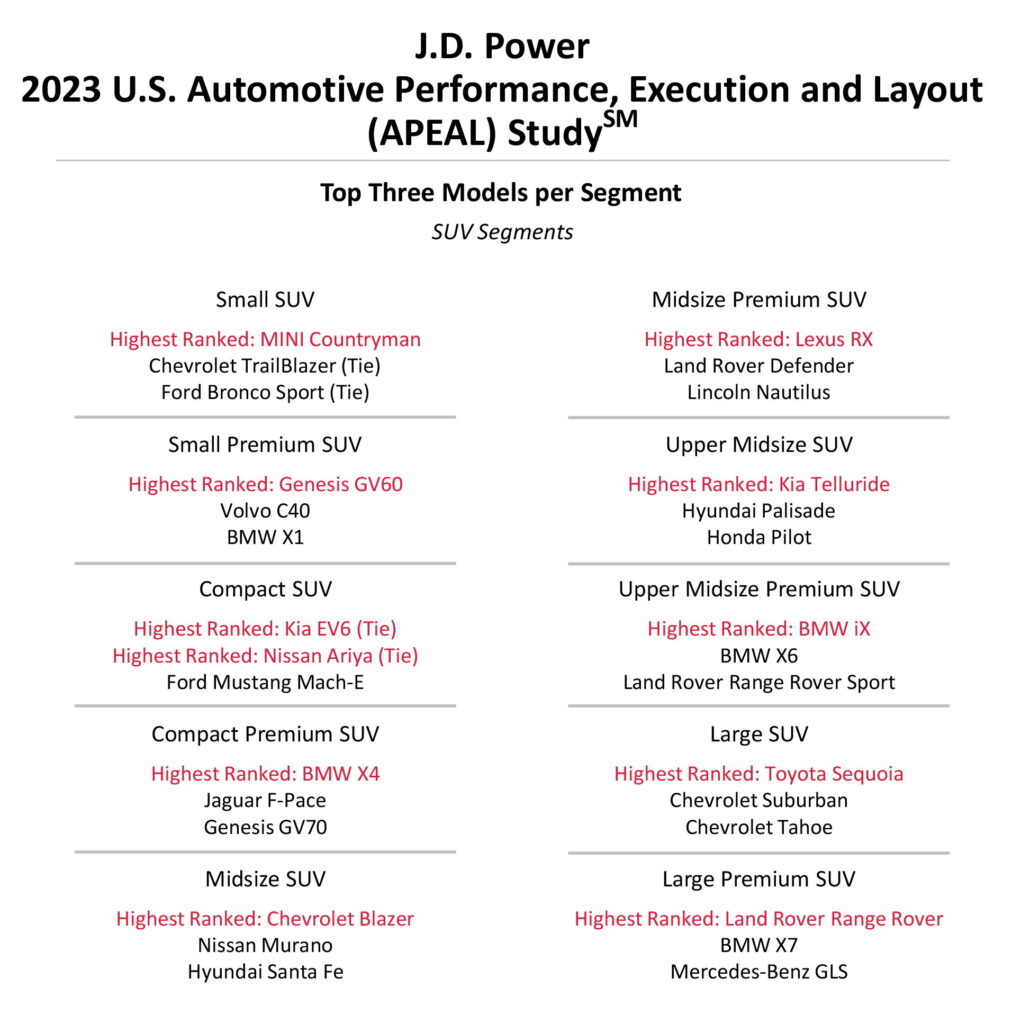

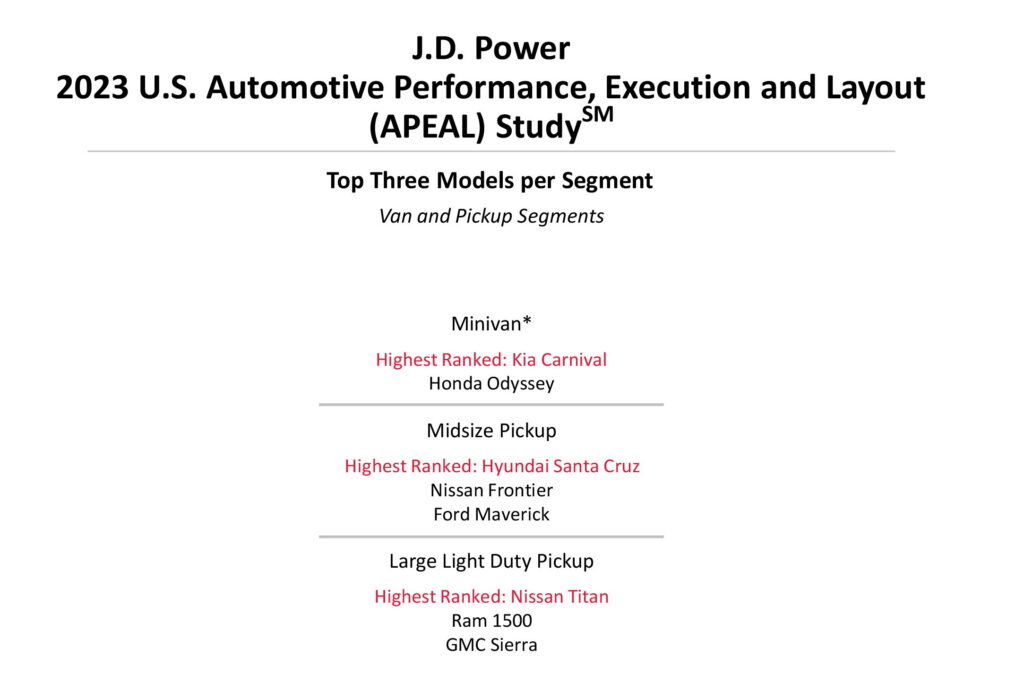

Because the brand still does not share its customer information with J.D. Power, it is not eligible for awards. Among brands that are, Hyundai took home the most vehicle-specific APEAL awards in 2023 with a record-setting nine awards. BMW has the second most with five, while Toyota has three.