Porsche chief financial officer Lutz Meschke has sounded a warning on high interest rates, stating that the luxury sector is not immune from the effects and will feel the pinch in 2024.

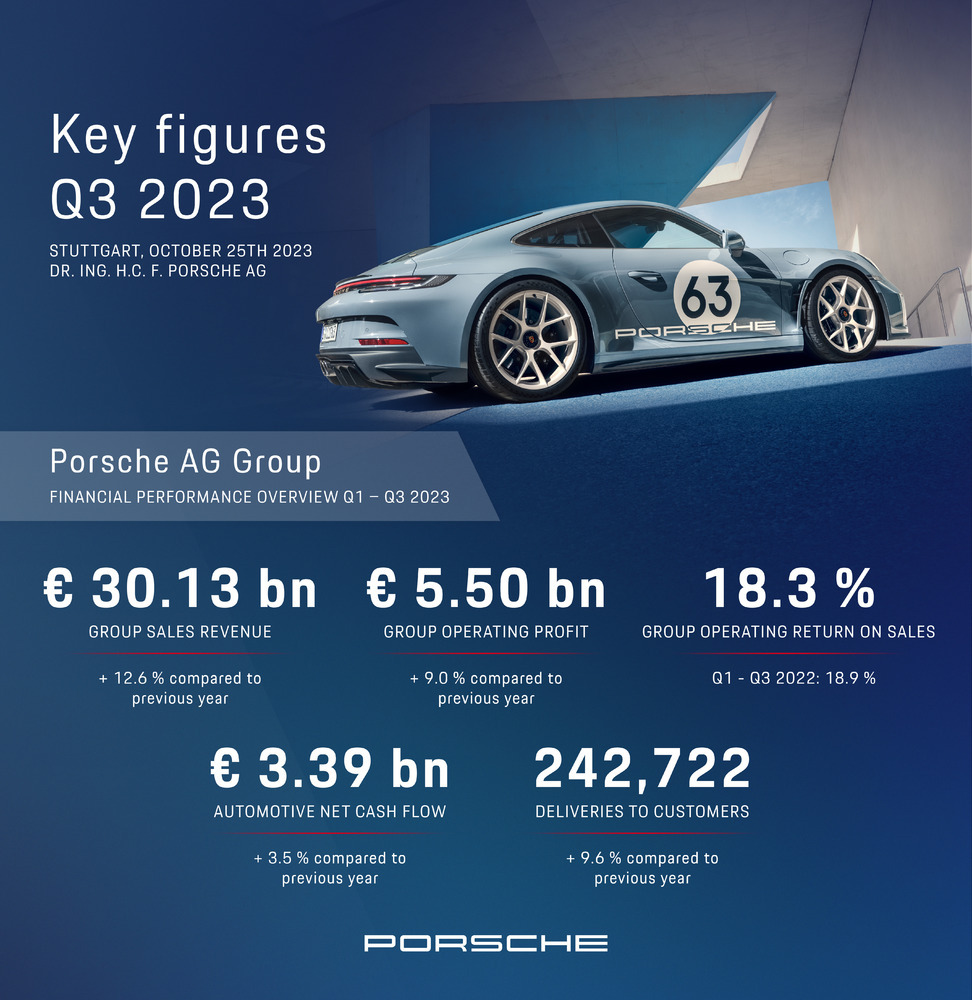

Meschke’s statements came after Porsche released its financials for the third quarter of this year. The carmaker performed well, reporting a 12.6% growth in sales revenue to €30.13 billion ($31.8 billion) and a 9% increase in operating profit to €5.5 billion ($5.8 billion). Customer deliveries also jumped 9.6% to 242,722 vehicles in the first nine months of the year.

Should the global economic and supply situation not worsen significantly before the end of the year, Porsche expects an operating return on sales of between 17-19%, slightly below its long-term goal of an operating return on sales of more than 20%.

Read: Porsche Design Boss Says Chinese Startups Will Force German Styling To Be More Daring

Despite these positive results, Porsche shares have dipped significantly over the past six months, falling from a high of around €58 ($61) in June to €43 ($45) as of October 25.

“Governments increased interest rates heavily… that creates a situation where customers are quite reluctant [to invest in] a new product,” Meschke said. “In 2024, we expect a challenging year due to the geopolitical situation and the economy in China. We are suffering in the entire economy. It is also hitting the luxury industry – you can follow it when it comes to share price development of all luxury retailers worldwide.”

While global sales of Porsche models increased globally, it has experienced a 12% drop in deliveries in China this year. Meschke told Reuters that Porsche executives recently visited China to speak with dealers and proposed the idea of opening new community centers to better promote its current and upcoming electric vehicles.

Meschke’s sentiments echo those of Tesla chief executive Elon Musk who recently expressed concern at rising interest rates during the carmaker’s most recent earnings call.

“If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car,” Musk said. “They simply can’t afford it. There’s going to be a broken record on the interest front. It’s just the interest rates have to come down. Like if interest rates keep rising, you just fundamentally reduce affordability.”