Daimler has a backup plan ready in case Li Shufu, the company’s biggest shareholder and founder of Geely, turns hostile.

Li Shufu acquired 9.7 percent of Daimler for around $9 billion back in February. The Chinese tycoon has since said that he isn’t going to grow his stake in the German car maker.

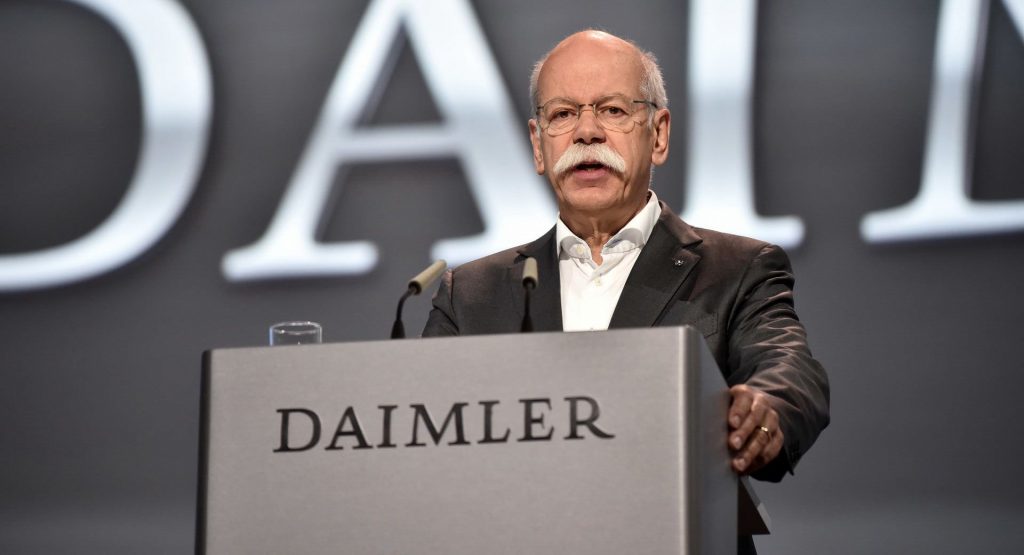

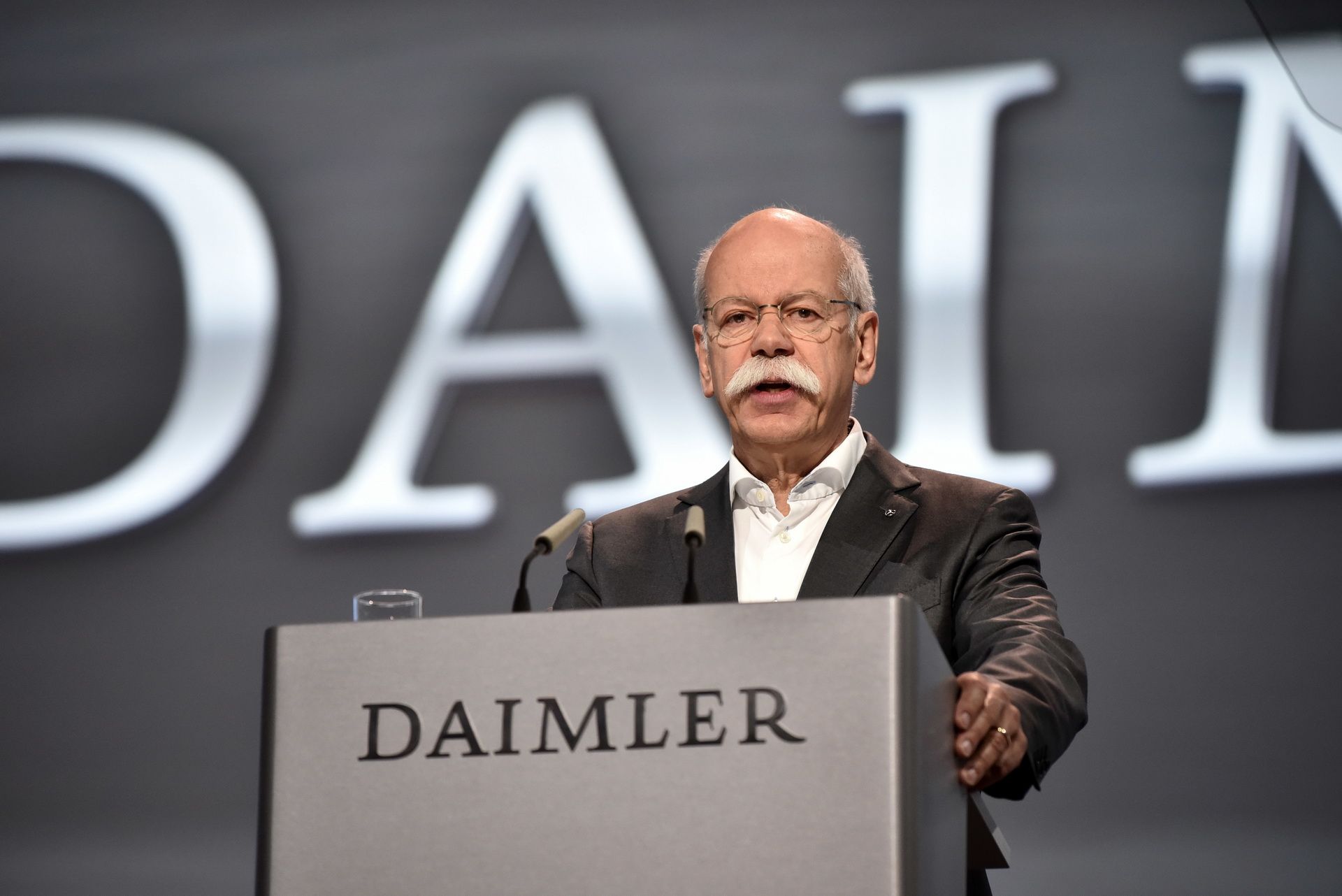

“We have dealt with such a theoretical [takeover] scenario and prepared ourselves, but there’s no reason whatsoever to think about that in this relation,” Daimler CEO Dieter Zetsche told Automotive News during the Beijing auto show last week, adding that nothing so far has indicated that Li was considering a hostile move.

“Of course, we have general plans – general – for such a situation, which we typically don’t announce, because then they already lose half of their effectiveness. But it’s clear that this is totally independent of this case.”

Zetsche added that he was “totally fine” with the company’s current stake holding and he didn’t ask for any guarantees from Li. With that said, any additional stake purchasing would be substantially more expensive, now that the markets began pricing with a possible takeover bid in mind.

Li has said in the past that he did not need the usual synergies for his $9-billion investment to pay off, suggesting that he would be perfectly happy receiving a dividend just like any other shareholder.

Zetsche said that talks with Li continued over the latter’s wish for a partnership but these haven’t gone beyond a simple exchange of views on the industry and its developments.

“Nothing is specific, even less so has anything been decided,” Zetsche said. “We are not even in the position to really define the areas of investigation, but it’s early stages so that’s totally normal. It’s very amicable and very constructive.”