Chinese car manufacturer Brilliance Auto Group is considering selling its remaining 25% stake in its joint venture with BMW in a bid to raise funds.

The firm’s joint venture with BMW serves as its most valuable asset and accounts for almost all of its net income. The duo originally had a 50-50 partnership but BMW spent €3.6 billion ($3.9 billion) in 2022 to lift its stake in the joint venture to 75%. Brilliance is currently in the midst of a restructuring after defaulting on debt payments in 2020 and being fined for numerous violations, including fabrication of earnings reports.

Auto News understands that no final decision has been made about whether or not the company will sell its 25% stake in the BMW joint venture.

Read: BMW Pays $4.2 Billion To Take Controlling Share Of Its Brilliance Auto Chinese Joint Venture

As part of the firm’s restructuring, the government of Chinese city Shenyang will repay Brilliance Auto’s creditors 16.4 billion yuan ($2.3 billion) in installments in exchange for a 29.99% stake in Brilliance China. Government officials claim to be unaware of any potential sale and representatives from Brilliance China have not responded to requests for comments on the report.

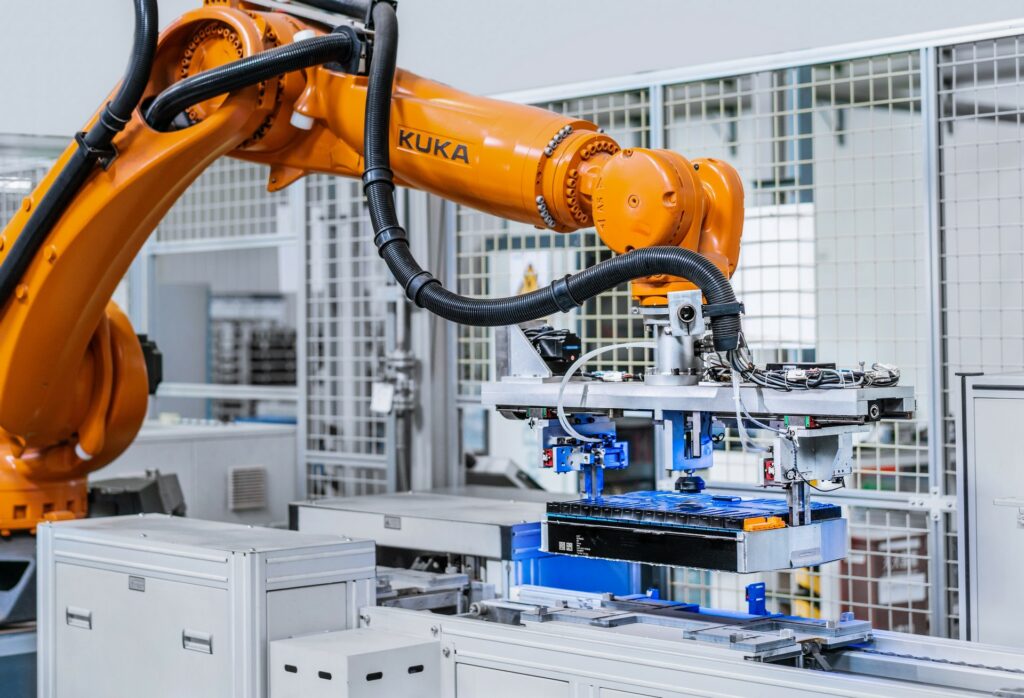

The BMW Brilliance Automotive joint venture operates both a research and development center as well as a powerplant plant in Shenyang. The joint venture intends to invest 10 billion yuan ($1.4 billion) in a battery assembly plant and will start to manufacture the German marque’s Neue Klasse-based battery-electric vehicles in Shenyang from 2026. It currently builds seven models and has an annual production capacity of 830,000 vehicles.

Media reports suggest that China FAW Group Co is involved in the deliberations on what to do with Brilliance.