Tariffs placed on EVs coming to the U.S. from China are designed to prevent a flood of cheap imports swamping the car market and to protect jobs in the domestic auto industry. But now the boss of Stellantis says he’s not bothered whether the Biden administration makes moves to protect Western carmakers against their Far Eastern rivals.

Though the current system of tariffs works as intended to keep Chinese imports out, concern is brewing that the country’s automakers will soon find a way into the U.S. market, most likely by establishing production sites in Mexico to take advantage of the free trade agreement between Mexico, Canada, and the United States.

That threat, plus worries over data security from ‘smart cars’ has led some in the auto industry to demand new tariffs to block cars with Chinese connections, regardless of where they were built. But Stellantis CEO Carlos Tavares thinks there’s no point in trying to put off the inevitable.

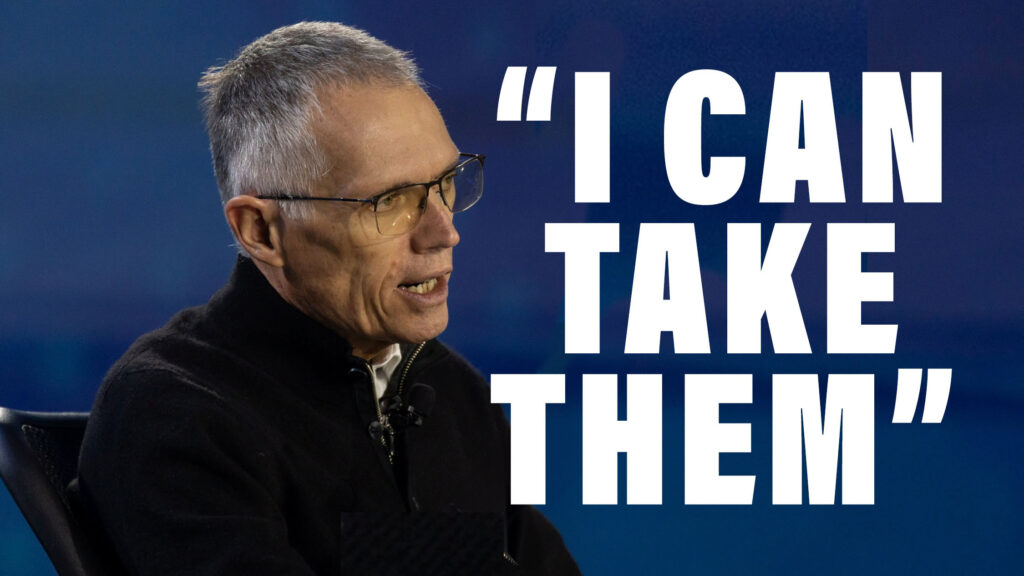

“I’m not asking for any kind of protection, because we are a global company, so I will not be protected everywhere,” Tavares told reporters this week, including those from Automotive News.

Related: Biden Administration May Raise Tariffs On Chinese-Made EVs

“Whatever the Western world will decide in terms of protections doesn’t fix the rest of the world. I will have to face the Chinese competitors in Latin America, I will have to face them in Africa-Middle East, I will have to face them in Asia…which means that my only option is to go head-on and fight.”

While he’s not able to go and do that quite yet because Chinese automakers are still the only ones able to sell battery-powered cars at petrol-powered prices, Tavares is working on closing the gap with cars like the new Citroen e-C3, a pocket-sized electric SUV that will launch at €23,300 ($25,200) this spring, but will eventually cost under €20k ($22k) when shorter-range versions arrive. Stellantis will also use the same low-cost “smart car” EV platform to sell similar vehicles from its other brands, though it’s unlikely any of them will make it to North America.

It’s also worth mentioning that Stellantis and Tavares have skin in the Chinese game through the joint venture set up with China’s Leapmotor last year. Stellantis bought a €1.5 billion ($1.6 bn) stake in Leapmotor and eventually plans to build cars in Europe, but will get the ball rolling by importing Chinese-built EVs to Europe this year.

Tavares’s laissez-faire attitude to tariffs contrasts starkly with that of Elon Musk, who recently warned that Chinese automakers would “pretty much demolish most other car companies” unless reined in by trade barriers.