Shell, the world’s second-largest fossil fuel explorer, currently operates over 46,000 retail locations globally, predominantly gas stations. By the end of 2025, it plans to close 1,000 of them, which represents less than 3 percent of the total. Despite the relatively small number, the London-based company says that this move will help meet the increasing demand for public charging stations for electric vehicles.

“We are upgrading our retail network, with expanded electric vehicle charging and convenience offers, in response to changing customer needs,” the oil and gas giant said in its Energy Transition Strategy 2024 document. “In total, we plan to divest around 500 Shell-owned sites (including joint ventures) a year in 2024 and 2025.”

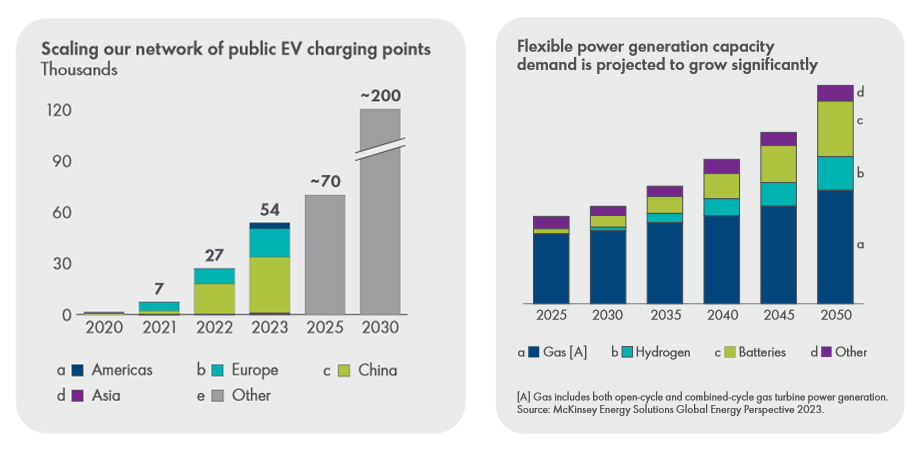

The company did not specify where the retail locations it shuts down are located. However, it did offer some details into its EV charging station goals. In 2023, the company had 54,000 charging points globally. It hopes to grow that to 70,000 in 2025, and to 200,000 by the end of the decade.

Read: BP Just Dropped $100 Million To Bring Tesla Superchargers To Its Gas Stations

“We are focusing on public charging, rather than home charging, because we believe it will be needed most by our customers,” the company wrote. “We have a major competitive advantage in terms of locations, as our global network of service stations is one of the largest in the world. We have other competitive advantages, such as our convenience retail offering which allows us to offer our customers coffee, food and other convenience items as they charge their cars.”

Once again, the company did not specify the locations of the new charging stations. Currently, the majority of its stations are situated in China. Europe represents another significant market, while only a minority of its sites are found in the Americas.

“The share of electric cars in new car sales has increased from less than 3% in 2018 to 18% in 2023,” the company said. “The most rapid growth is in China, the world’s largest car market, followed by Europe and the USA. In China, there are a wide range of vehicles for sale at under $40,000, while in other markets electric vehicles generally sell at above this price before government subsidies are applied.”

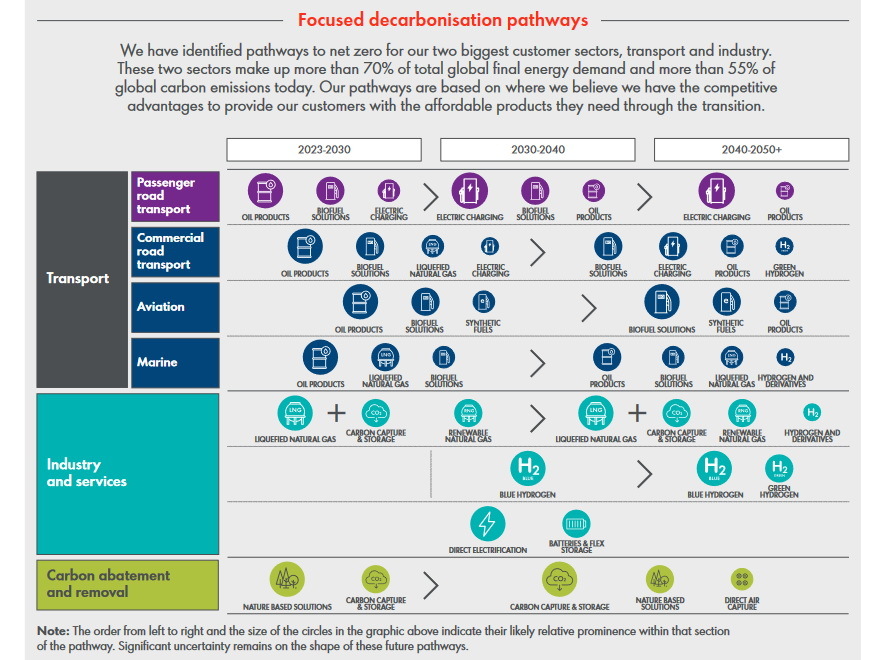

The other pillar of Shell’s 2030 strategy is e-fuels, which it says it is also expanding. It plans to supply the aviation and shipping industries with plant-based biofuels and hydrogen-based fuels in the future.

However, before we give the company too much credit, these announcements come just a week after Shell weakened its carbon-emission reduction targets for the coming decade. It says that it is sticking to its mission of becoming a net-zero company by 2050, though.