Bentley has a problem. Truthfully, it’s the kind of problem every manufacturer would like to have, but it’s a problem nonetheless. The company has stretched itself thin, offering the most outlandish customizations buyers could want. While demand has exponentially bolstered Bentley’s finances, the company is facing struggles as it tries to keep up.

The Mulliner name has been associated with Bentley for decades, but in 2014, the division was tasked with catering to customers who wanted to add something a bit more special to their new cars. To put it into perspective, it took Mulliner seven years to shift 1,000 commissions, with the milestone being set in 2021. In 2022 the company recorded more than 500 Mulliner commissions in a single year. The company reported a further 43 percent increase in 2023.

Also: Bentley Mulliner Shows How They Are Building The First New Customer Speed Six Since 1930

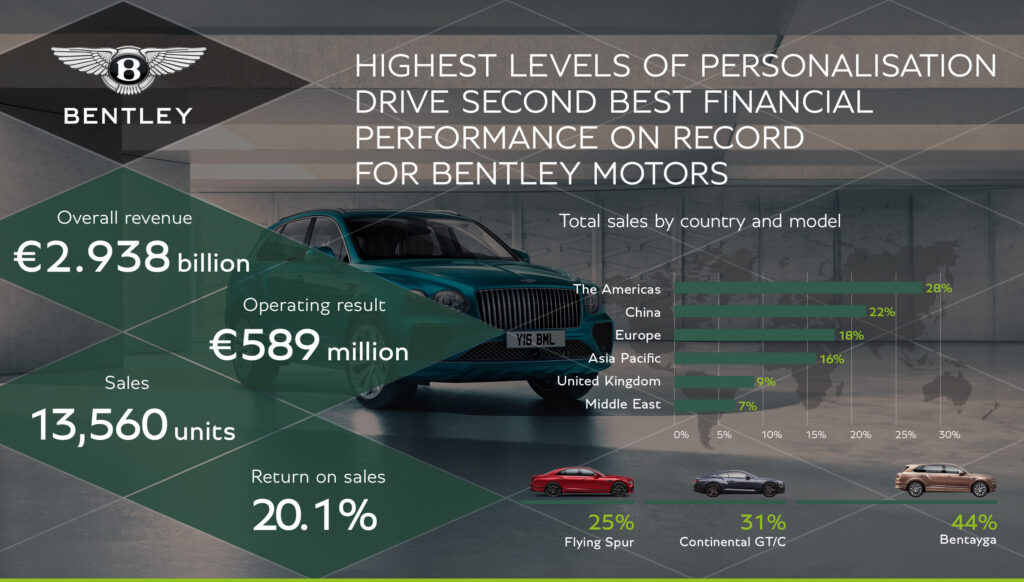

And while Bentley did see a downturn in overall units sold last year, finances and profitability were propped up thanks to the extensive range of customization the company offers. And when we say extensive, we mean it — there are a staggering 46 billion different configurations within the standard range.

“Customers demanded it, we’ve streamlined production, and it’s experiencing exponential growth,” Bentley’s (now former) CEO Adrian Hallmark told reporters during a call discussing the company’s financial results, as reported by Bloomberg, just days before he abruptly announced stepping down to take over the reins of another luxury British firm, Aston Martin.

“On just a few thousand more cars than we used to sell in the 2000s, we’re now making three to four times the profit per year,” Hallmark stated. He also noted that last year, over 70% of Bentleys purchased were equipped with content from the Mulliner business – and that’s in addition to the average €39,000 (about $43,000 at current exchange rates) worth of options the company sells per car.

While the company enters into a new era, after its CEO resigned, there are still challenges ahead. Bentley has had to put plans for its first BEV on ice, delaying the launch by 12 months, into 2026. This is expected to have a knock-on effect on the brand’s larger lineup of EV offerings.

Instead, the company has seen promise in hybrids. Much like other premium brands in the VW Group, EV launches will be spaced out. Later this year we’ll see refreshed Continental GTs and Flying Spurs, with four new plug-in hybrid models.

Perhaps the biggest worry for the short-term is China. Bloomberg reports that China represents the second-largest market for Bentley. But thanks to increased interest rates, a decline in the property market, and an uncertain economic outlook, sales have taken a dip. And with EVs being a popular option in that part of the world, Bentley will have to hope that its Mulliner division continues to rake it in.