More than 70 percent of American consumers are considering buying an electric vehicle in the near or long-term future. However, to convert that interest into actual sales, automakers will have to deliver a lot of performance at a low cost, which will be very difficult.

A new study finds that automakers lose an average of around $6,000 on each EV they sell for $50,000, after accounting for tax credits. While improving technology and economies of scale will help to reduce those losses, it will take more government support and aggressive efficiency programs to make EVs actually profitable.

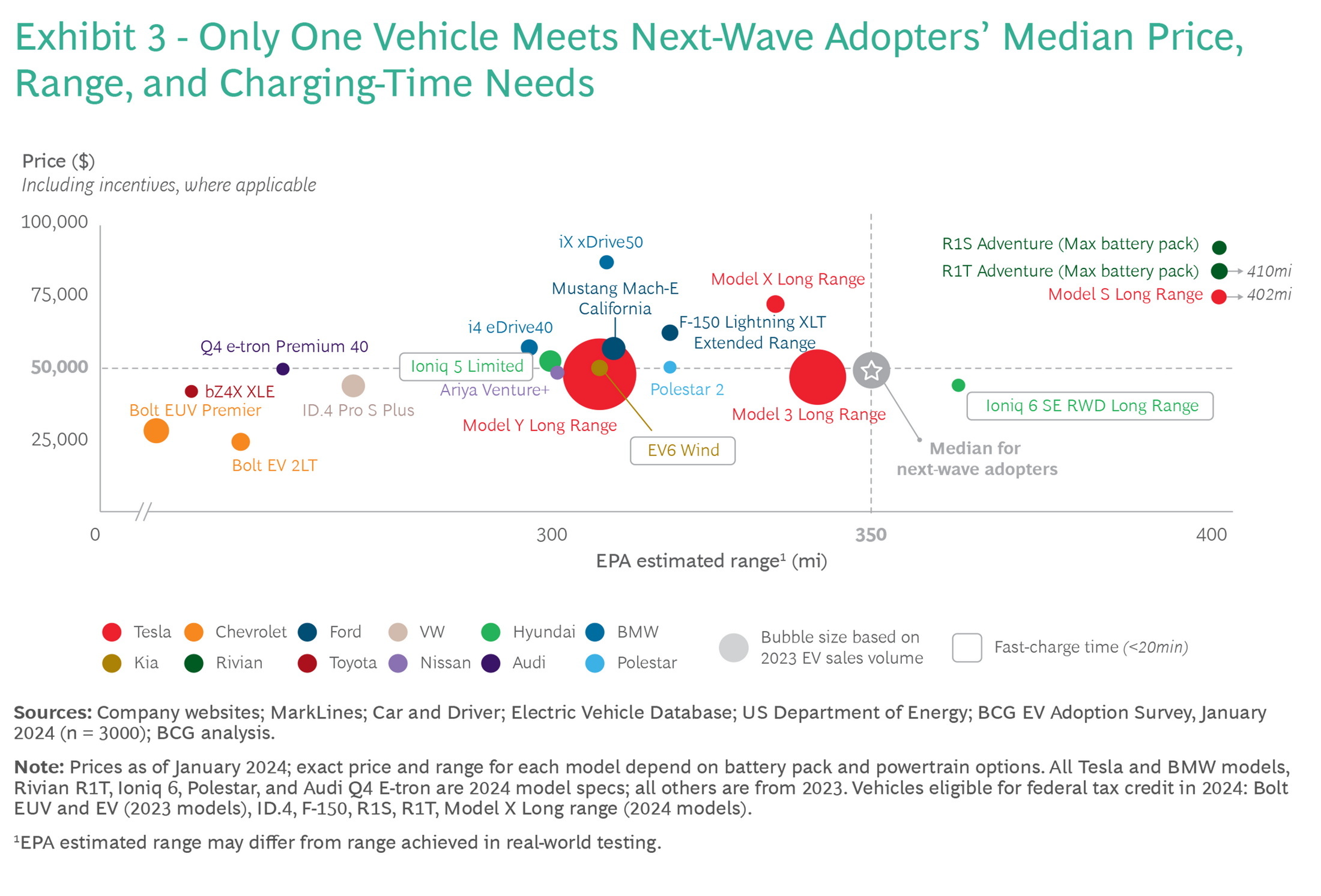

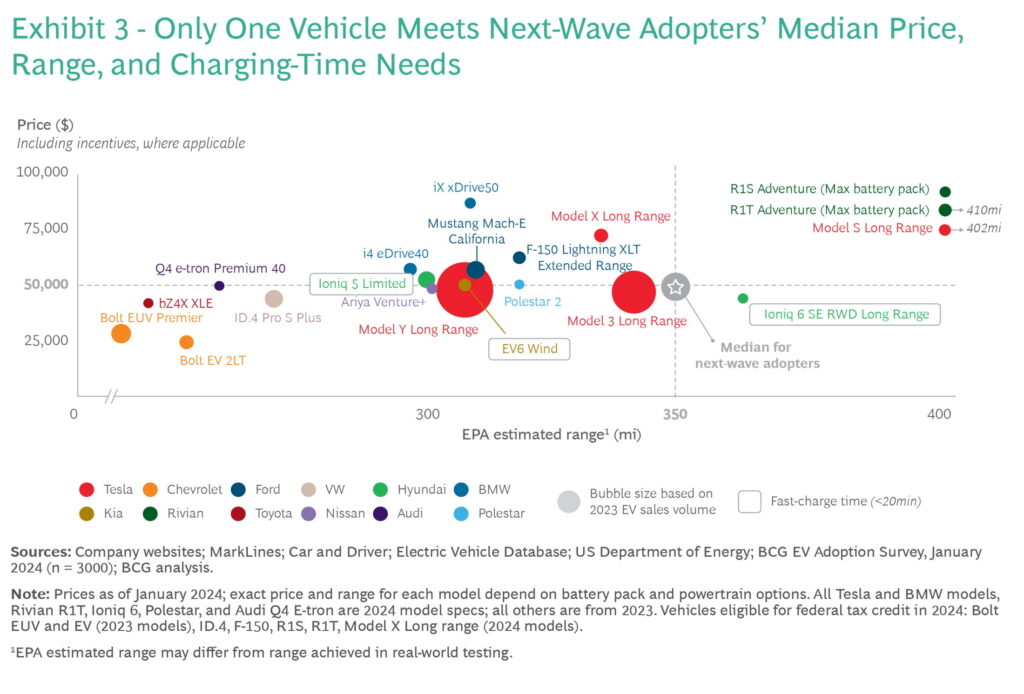

And automakers will have to do that as customers demand more and more from new EVs. BCG research finds that the next wave of EV adopters are eager to buy, but want a vehicle that can be charged in 20 minutes, offers a range of 350 miles (563 km), and is priced at around $50,000 or lower.

BCG found just one vehicle on the market today that satisfies every consumer desire listed above, and it’s the Hyundai Ioniq 6 SE RWD Long Range. The good news is that the next generation of EVs is just around the corner, and they will be able to satisfy many of these needs.

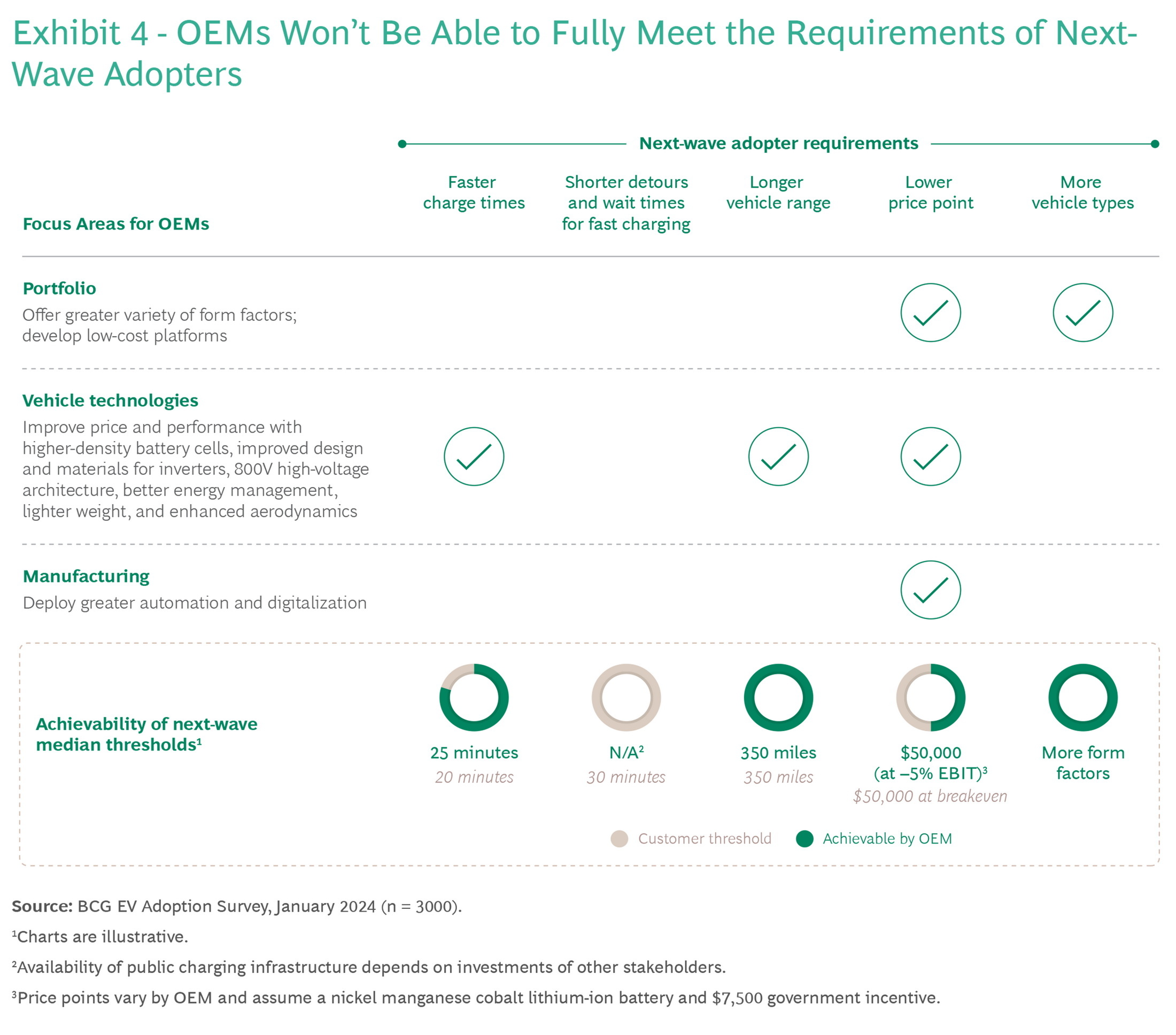

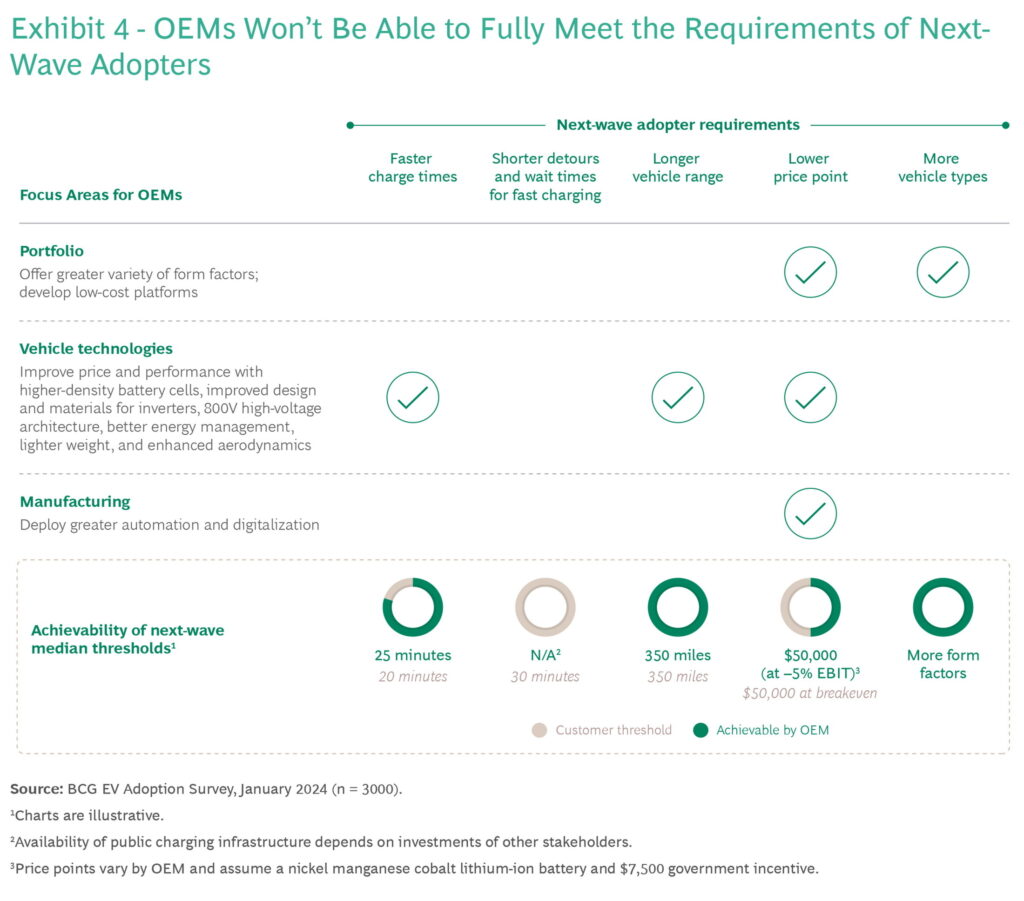

Battery technology and software improvements mean that a 350-mile driving range isn’t that difficult, but filling the battery in 20 minutes is harder. BCG reports that 25-minute charging will be more easily achievable and that the greater variety of models coming out in the future will serve a broader team of buyers.

But still, making an EV that’s profitable at $50,000 will be difficult according to the survey. Researchers at Gartner recently estimated that improvements in production technology could help make EVs cheaper to make than internal combustion cars by 2027. Unfortunately, though, that is not without compromises, as the price of repairs will go up as a result of those upcoming production efficiencies.

Read: EV Production Costs To Beat ICE By 2027, But 15% Of Startups To Fold, Study Says

One way or another, consumers’ median desires aren’t set in stone. Buyers are willing to deal with shorter-range EVs if that means these are cheaper to buy. Across the market, about 12 percent of consumers are satisfied with EVs on the road today and BCG estimates this will increase to between 20 and 30 percent when the next-gen EVs arrive.

As for buyers who won’t be satisfied by even the next generation of EVs, they could easily be swayed by hybrids, which are expected to make up between 15 and 20 percent of the U.S. market from 2026 onwards. The remaining 55 to 60 percent are expected to be powered by internal combustion engines.

The next generation of EV adopters will be a lot like today’s EV buyers, a majority of whom are well-payed, millennial men, and with an interest in tech. However, they will have higher expectations of their vehicles and care less about EV-specific features, like a frunk.

That means that focusing on good value will be more important to the segment than it has been in the past, putting further pressure on automakers to control costs. However, the good news is that the market is out there, even if the segment is set to get more and more competitive.