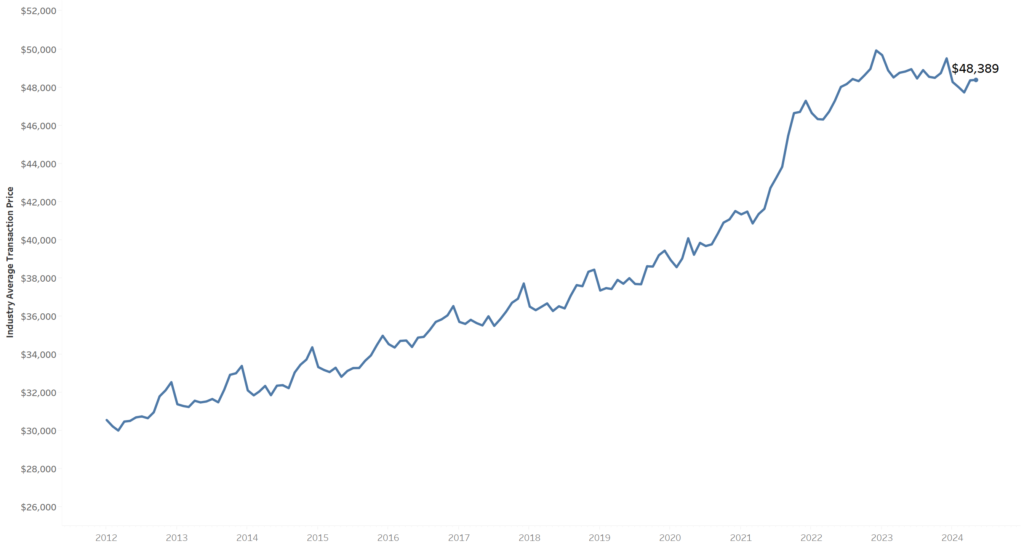

- The average transaction price (ATP) for a new vehicle in the U.S. was $48,389.

- Average car prices are trending down, with inventories remaining high.

- The pickup segment remains home to four of the best-selling vehicles in the U.S., each with ATPs over $60,000.

It’s good news for buyers and less so for dealers, as the latest information from Kelley Blue Book shows that the average price of new car transactions continues to trend down. New vehicle prices in May remained lower year-over-year for the eighth consecutive month, driven by increasing inventory levels.

Data shows that that the average transaction price (ATP) for a new vehicle in the U.S. was $48,389, representing a 0.9% drop from May 2023. This translates to a decrease of approximately $442, providing some relief for consumers facing high inflation.

Read: TLX Sales Plunge 76% In May, Acura Blames Factory Retooling

“In May, we saw some positive news on the sales front,” said Erin Keating, executive analyst for Cox Automotive. “A lot of those sales gains were juiced by higher incentives and lower prices, which is good news for consumers worrying about inflation. While there are a lot of vehicles transacting at very high prices, that doesn’t mean all new vehicles are unaffordable. There are still plenty of excellent, well-priced vehicles out there, particularly in the compact segments.”

The share of vehicles transacting below $40,000 increased in May compared to May 2023, suggesting a shift toward more affordable models. Cars under $40,000 accounted for 41.2% of new-vehicle sales in May, up from 36.8% a year ago. Kelley Blue Book identified approximately 70 different models available below $40,000. Only one model with significant sales volume, the Mitsubishi Mirage, transacted below $20,000.

Five of the top 10 best-selling vehicles had transaction prices below $40,000, well below the national ATP of $48,389. For instance, the Toyota RAV4, the third most popular vehicle in the U.S., had an average transaction price of $37,608. Similarly, the Honda CR-V, fourth in sales, had an ATP of $37,364, nearly 23% below the national average.

Many brands have more than 100 days of supply, with only Toyota, Lexus, and Honda having less than 60 days’ supply. Higher inventory levels mean that dealers are more likely to negotiate, while more incentives are typically on offer as well.

Conversely, nearly 100 different models had ATPs over $60,000 in May, accounting for 26.4% of total sales, up from 20.4% in May 2023. On the higher end of the market, four of the top 10 best-selling vehicles in the U.S. were full-size pickup trucks, each with an ATP of above $60,000. Of course, the popularity of luxury pick-up sales is generally unique to the U.S. market, which is why BMW’s ATP of $72,946 is only marginally higher than the F-Series’ $67,937. The F-Series also managed to outsell BMW 2-1 in May.

Meanwhile, EV prices have once again been on the rise. Tesla’s ATP — with the brand counting for nearly 50 percent of all EV sales in America — increased by 10 percent to $57,369 from 2023, likely helped by the rollout of the Cybertruck. However, industry-wide EV prices were 4.1% lower year-over-year but increased in May to $56,648, up 2.6% from April.