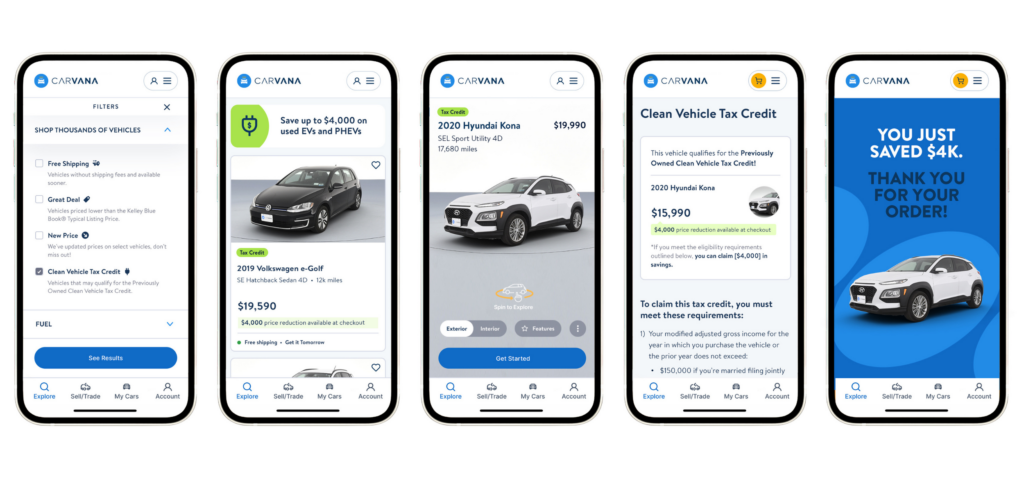

- Used vehicle buyers can now instantly apply for up to $4,000 in tax credits with Carvana.

- The online marketplace features around 40 eligible makes and models on its platform.

- Buyers must meet income and other requirements to qualify for the credit.

Consumers seeking pre-owned electric vehicle or plug-in hybrids in the United States can now benefit from a streamlined tax credit process offered by online used car retailer Carvana.

The company has implemented a system that directly applies up to $4,000 federal tax credit to eligible used EVs and PHEVs at the point of purchase, making the process a a little less bureaucratic that it has been in the past.

Read: Man Buys Car From Carvana, A Year Later Police Show Up And Confiscate It For Being Stolen

Updates to Carvana’s platform mean that a used vehicle’s eligibility for the Clean Vehicle Tax Credit is checked and instantly applied at checkout, as long as shoppers are happy to transfer their credit to Carvana.

“We provide the customer with the paperwork needed for their tax return,” a company spokesperson told The Verge. “Carvana then takes care of sending everything to the IRS portal for vehicle eligibility. So, it should make a customer’s tax return easier and less stressful as it relates to this credit.”

Before industry changes were made last year, the only way to get the used car tax credit was to wait until tax time came the following year.

“Carvana has always believed in using technology to make the car buying process easier, more transparent and more accessible for our customers,” Carvana chief product officer Dan Gill said.

The credit can also be applied to eligible shoppers who finance their purchases. Speaking with Auto News, Carvana added that it had roughly 40 eligible makes and models available on its platform in the first quarter, totaling hundreds of eligible vehicles.

Not all used EVs, PHEVs, and fuel cell vehicles will qualify for the credit. Eligible vehicles must be priced at $25,000 or less and weigh less than 14,000 lbs (6,350 kg). Individual buyers earning more than $75,000, heads of households earning over $112,500, or married couples jointly earning above $150,000 are ineligible.

Additionally, the vehicle must be purchased for personal use and primarily used within the United States.

Earlier this year, the U.S. Department of Treasury and the Internal Revenue Service revealed that more than $1 billion in credits had been handed out to the buyers of new and used EVs across the country since January. It said over 125,000 new vehicles had been purchased with the assistance of tax credits, while 25,000 used cars were bought and eligible for up to $4,000 each.