- A new Mitchell study shows that BEV collision claims frequency continues to rise.

- Despite slower sales growth, BEV collision claims in the U.S. increased by 2.5% in Q2 2024.

- Repair costs for electric cars are 20% higher than for ICE vehicles in the USA.

Despite the recent slowdown in electric vehicle sales growth, the number of collision claims involving BEVs continues to rise in North America. While their frames may be less prone to damage, repairing EVs often comes with a heftier price tag compared to traditional ICE-powered vehicles.

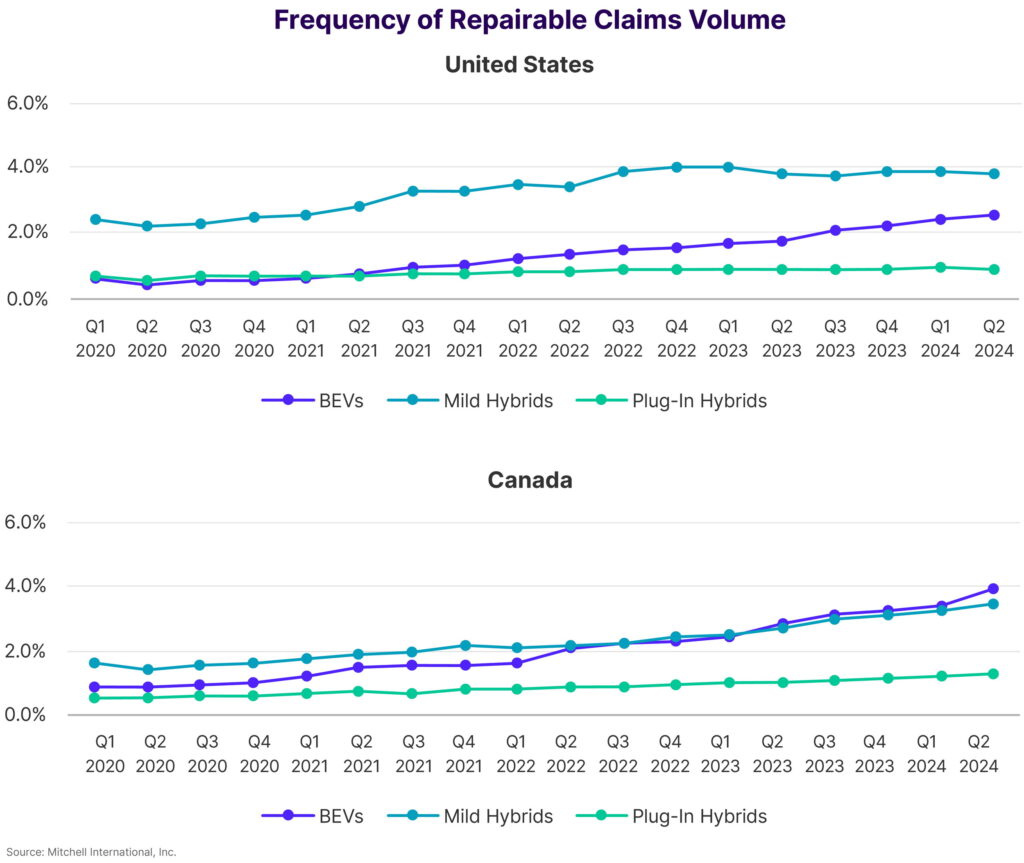

According to the latest study by Mitchell, claims for repairable collision-damaged BEVs rose by 2.5 percent in the US and 3.95 percent in Canada during Q2 2024. This increase came despite a slowdown in sales that led to a dip in BEVs’ market share, falling to 9.3% in Q1 2024 from 10.2% in Q3 2023 in the U.S.

More: Automated Driving Tech Doesn’t Improve Safety, Crash Avoidance Tech Does, Says New Study

Mitchell reports that the average claim severity for repairable BEVs in Q2 2024 was $5,753 in the U.S. and CAD $6,534 in Canada. In contrast, ICE-powered vehicles averaged significantly lower costs at $4,806 in the U.S. and CAD $4,958 in Canada. This means repairing collision-damaged BEVs was 20% more expensive in the U.S. and a staggering 31% more expensive in Canada compared to similarly-sized ICE vehicles.

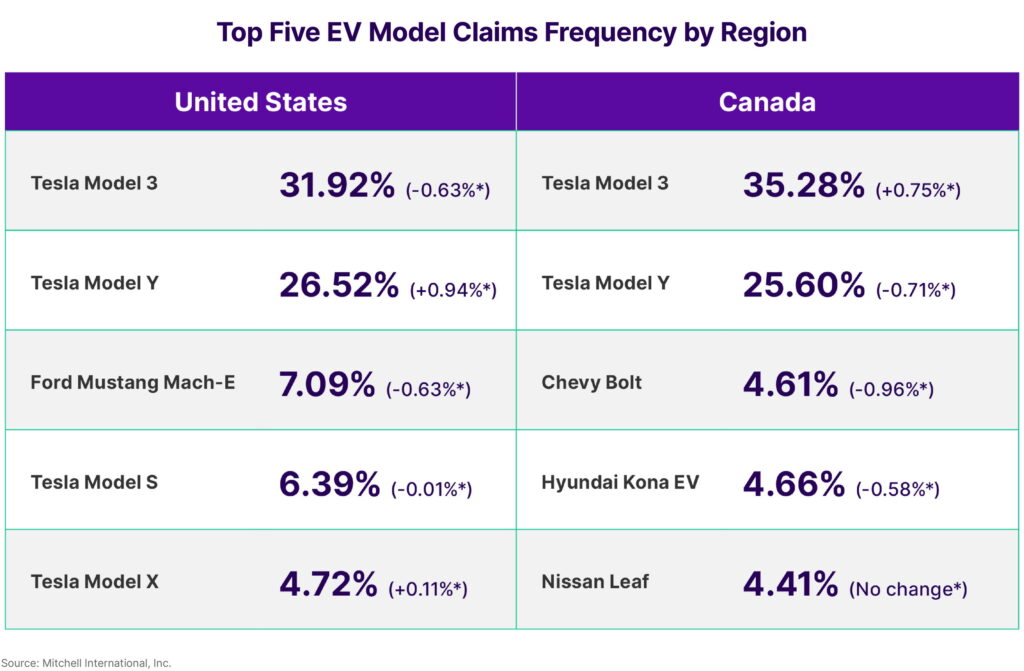

When it comes to makes and models, the Tesla Model 3 and Model Y lead the pack in claims frequency among BEVs in both the U.S. and Canada, accounting for more than half of all cases. This isn’t surprising, given their sheer numbers on the road, which naturally increases their likelihood of being involved in accidents compared to less common EVs.

Claims frequency has also increased for hybrids. Mild-hybrids, which are technically similar to ICE-powered vehicles, have comparable repair costs in the U.S. However, the more complex plug-in hybrids tell a different story, with repair costs soaring 12.5% higher than those for ICE vehicles after a collision.

Total loss frequency is strikingly similar between newer ICE vehicles and BEVs, with rates of 9.45% and 9.16%, respectively. This parity is driven by the growing complexity of modern vehicles, making them increasingly difficult and costly to repair.

Another interesting fact is that while BEVs require more mechanical labor hours per appraisal on average, they are less likely to need frame repairs compared to ICE-powered equivalents (5.21 percent against 8.18 percent). This suggests that the structural integrity of EVs might be higher than ICE, though more data is needed to confirm this.