- A viral tweet claimed that Geico had declined insurance coverage for the Tesla Cybertruck, causing confusion.

- In a statement, the insurer confirmed that it still offers nationwide coverage for the Tesla Cybertruck and other EVs.

- Generally, Tesla vehicles tend to have higher insurance rates due to unique repair costs and parts availability issues.

A now-deleted post on X over the weekend claimed that insurance provider Geico had refused to cover a Tesla owner’s Cybertruck. However, it turns out this was just another piece of internet fiction, as Geico confirmed to us they still offer nationwide coverage for the fully electric truck (despite its many quirks and complications, but who’s counting, right?).

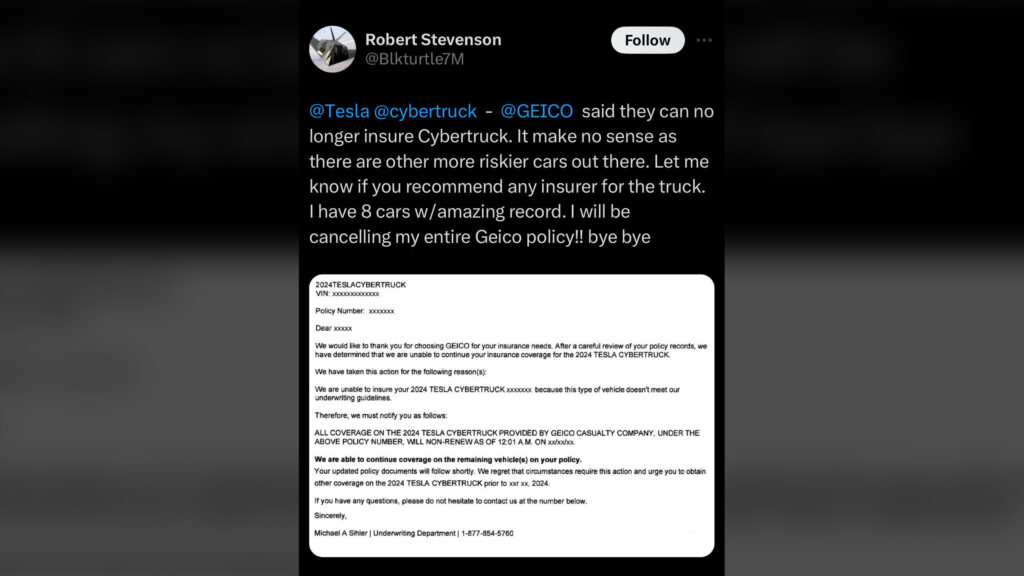

The viral post, which made the rounds on X and Reddit, included a screenshot of an email supposedly sent to a Cybertruck owner. It read: “After a careful review of your policy records, we have determined that we are unable to continue your insurance coverage for the 2024 Tesla Cybertruck,” adding that this particular vehicle “doesn’t meet our underwriting guidelines.” Sounds dramatic, right? Well, not so much.

More: Brace Yourself For Another 22% Car Insurance Price Jump This Year

Carscoops reached out to Geico for a comment, and their response was about as straightforward as it gets: “GEICO has coverage available nationwide for the Tesla Cybertruck,” a spokesperson told us. Short, sweet, and basically saying, “Yeah, this whole thing? Completely made up.” While the spokesperson didn’t dignify the viral post with any further acknowledgment, their message made it clear that any talk of a policy change was just another internet rumor spiraling out of control.

Of course, that didn’t stop many social media users from buying into the story. Had it been true, it likely would’ve triggered a domino effect with other insurance providers. Tesla’s Cybertruck, after all, has had its fair share of issues since its debut—thanks to what some might call an experimental R&D phase.

But honestly, the real headache isn’t the truck’s design. It’s the prolonged wait times, the shortages of replacement parts (did someone say “post-apocalyptic scavenger hunt”?), and the high prices at Tesla service centers—particularly for the Cybertruck, which somehow always manages to up the ante.

One Reddit user, Witchfinger84, claimed that Tesla’s own insurance company is “artificially deflating the cost of insurance to keep the rates competitive.” They even went so far as to describe Tesla EVs as “car insurance time bombs,” due to the hefty repair bills and long delays in getting parts after an accident. Not surprisingly, many other Tesla owners have voiced similar complaints about their skyrocketing insurance premiums. Funny how that works.

In the same thread, another Reddit user called Nopengnogain, said that he was quoted 60-90 percent higher insurance rates for new or used Tesla vehicles compared to similarly-priced EVs from other automakers.

For context, Geico ranks as the second-largest auto insurer in the United States, just behind State Farm and ahead of Progressive, covering around 30 million vehicles. So, rest assured, if there were really any major policy changes regarding the Cybertruck, you’d probably hear about it from somewhere a little more reliable than a now-deleted X post.