- The carmaker will start to produce lithium-iron-phosphate batteries in North America.

- Kurt Kelty from GM believes the US can grow much like Asia has done over the past 20 years.

The boss of GM’s battery department believes the U.S. can lead the world on EV batteries thanks to a strong local customer base and government policies encouraging local development and manufacturing of battery cells.

China has firmly established itself as the leader in EV batteries, in part thanks to generous government subsidies that supported the development of the industry over the past 15 years. Chinese manufacturers have also led the way with lithium-iron-phosphate batteries and control a lot of the core materials required to make them. In fact, it’s home to most of the world’s refinery capacity for materials, including cobalt, nickel sulfate, graphite, and lithium hydroxide.

Read: GM Could Use Chinese Battery Cells Built In The US By Japanese Brand

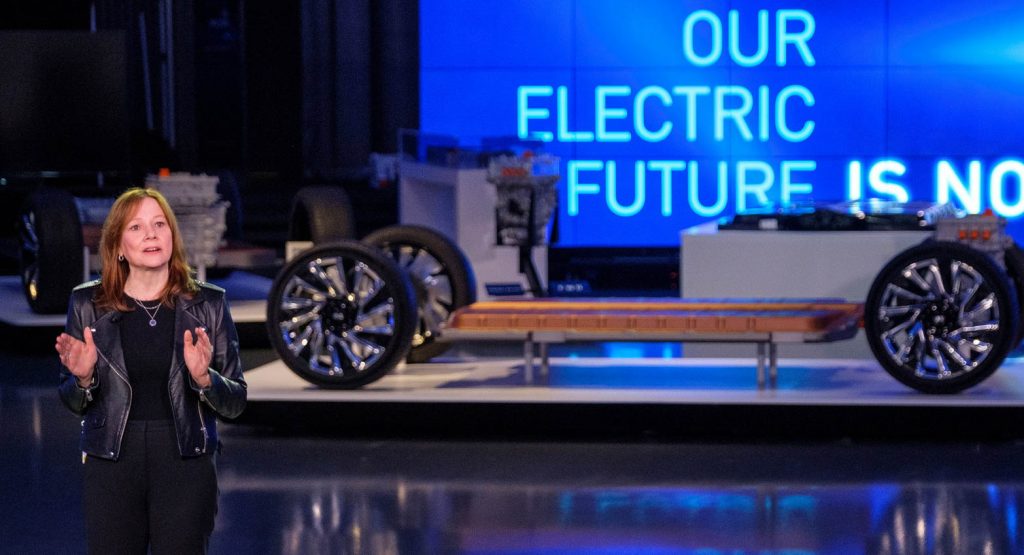

However, while speaking at The Battery Show in Detroit, GM’s vice president of batteries, Kurt Kelty, expressed optimism that the U.S. can seize global leadership on EV batteries.

“It’s a simple and pragmatic reality that the development of any new technology benefits from proximity to customers,” he said. “Today, we have those customers. We now have the customers here in the States, and we have public policies that are supportive of manufacturing cells here.”

Kelty said the U.S. has the potential to grow EV battery development and manufacturing over the coming years in a similar way to what’s happened in Asia over the past two decades. In the coming years, GM will add lithium-iron-phosphate batteries to its North American portfolio, Auto News reports.

Local manufacturing of these cells will drive down costs. Cells using this chemistry in China can cost as little as $50 per kilowatt hour, giving firms a competitive advantage.

“Once we get LFP manufacturing in the U.S. and we get the expertise about how to manufacture it, we’ll be able to drive down costs on LFP similar to how Asian companies have done in the past,” Kelty added.