- Last month, 106,155 new EVs were sold in the U.S., a 2.3% increase year-over-year.

- Higher incentives and improved leasing options are key factors behind the EV sales surge.

- The average transaction price for new EVs dropped to $56,902, down 1.2% month-over-month.

While the growth in electric vehicle sales has slowed throughout much of 2024, this year is still shaping up to break records for both new and used EV sales across the United States. The shift toward electrification remains one of the most pivotal trends in the automotive world, and even with a few bumps along the way, the market is continuing to evolve.

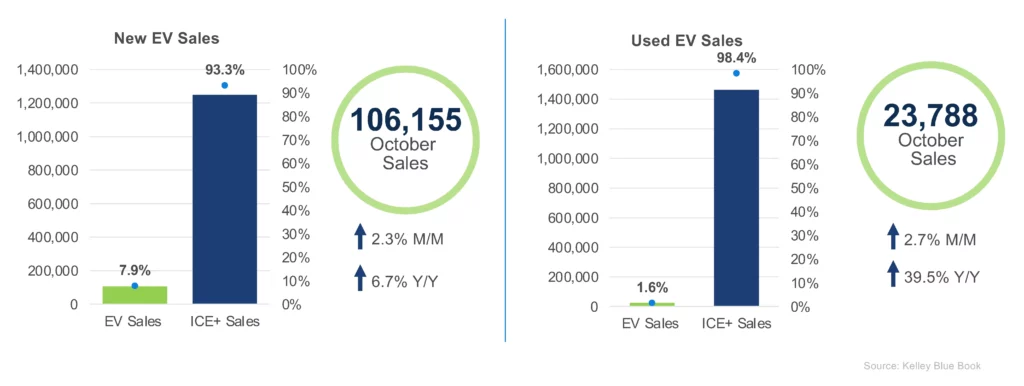

According to recent data published by Cox Automotive, October saw 106,155 new EVs sold across the country, representing a 2.3% increase from September and a 6.7% rise year-to-date. This solid performance means that over 1 million new EVs have been sold in the USA through the first ten months of 2024.

Read: Global Electrified Sales Soared 31% In September, Driven By China’s Boom

Electric models now make up a significant 7.9% of the total new car market, a figure that highlights the segment’s growing share despite a broader industry slowdown.

Incentives And Leasing Drive the Growth

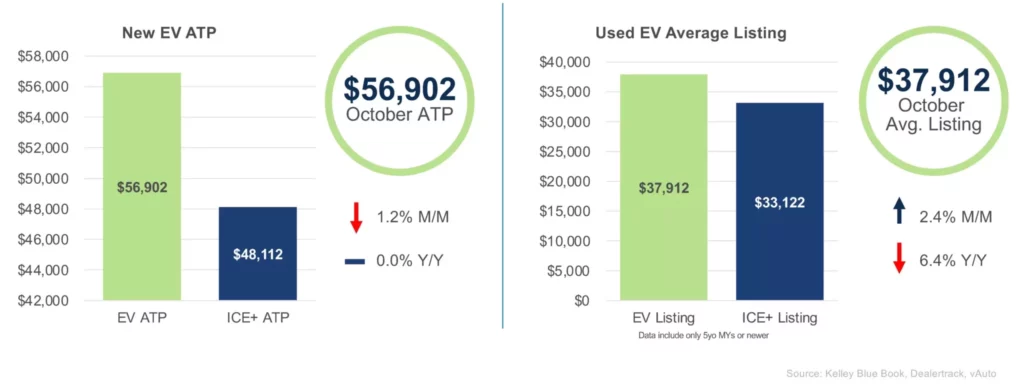

Two of the key reasons behind this growth are stronger incentives and more attractive leasing options. Cox Automotive reports that incentives on new EVs in October represented 13.7% of the average transaction price. This trend has undoubtedly helped tip the scales for buyers who might have otherwise been hesitant. Speaking of price, the average transaction price for a new EV last month was $56,902, marking a modest 1.2% decrease from the previous month, which suggests that price sensitivity may be easing as the market matures.

It’s clear that price isn’t the only factor driving new EV purchases. Leasing, too, has become a more favorable option for consumers looking to get into the EV game with less financial commitment upfront. This shift, combined with incentives, has helped sustain EV momentum even as broader car sales have slowed.

Used EV Market Grows Rapidly

The used EV market is experiencing a boom of its own. In October, 23,788 used EVs were sold—a 2.7% increase from September and a staggering 39.5% jump year-over-year. Used EVs now make up 1.6% of the overall used car market.

Meanwhile, the average listing price for a used EV in October fell to $37,912, marking a 6.4% decrease compared to the previous year. This decline suggests that as new EVs become more affordable, their used counterparts are following suit, providing a more accessible entry point for buyers. However, this also means current owners are facing higher depreciation.

Supply And Demand Shifts

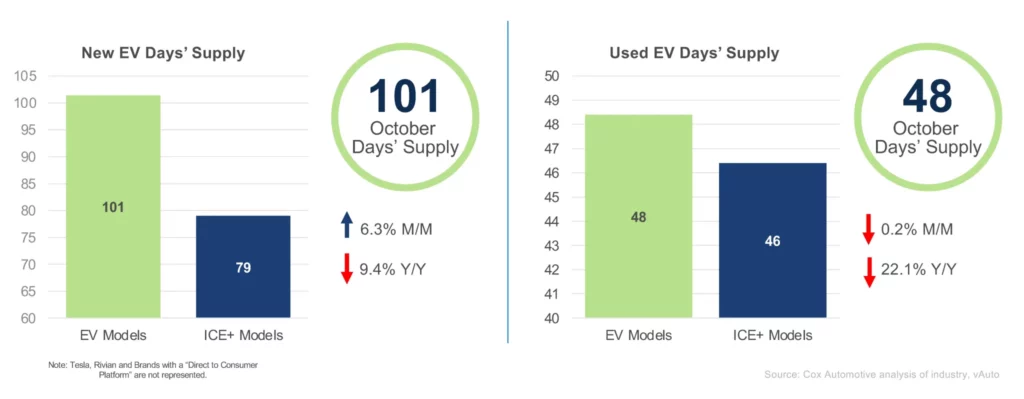

As the market for both new and used EVs grows, supply dynamics are also shifting. Last month, the average supply of new EVs on dealer lots was 101 days, marking a 6.3% increase from the previous month. However, it’s a 9.3% drop from the same time last year, signaling that EVs are moving faster through dealerships. In comparison, used EVs had an average supply of 48 days, holding steady month-over-month and remaining just two days higher than used internal combustion engine (ICE) models, which averaged 46 days.

More: California To Reinstate EV Rebates If Trump Scraps Tax Credit, Just Not For Tesla

Despite the broader slowdown in 2024, the U.S. EV market remains robust. At the end of the third quarter, EV sales in the country had surged 11% year over year and reached an all-time high of 8.9% of the new car market. This strong rebound indicates that interest, at least for now, in the segment is far from fading, even as overall EV growth momentum wavered earlier in the year.

Uncertainty Ahead

However, it remains to be seen how the EV market will respond next year when the Trump administration takes office. The new leadership has promised to slash federal electric vehicle subsidies, a move that could disrupt the industry’s momentum, even if state-level rebates, like those in California, remain intact.