- Nissan’s global production has fallen by 7.1 percent so far this year

- However, the brand’s sales have managed a slight 0.1 percent increase.

- It could soon face bigger issues from potential Trump administration tariffs.

Nissan appears to be fully in what its CEO has described as “emergency mode.” After committing to hefty job cuts and potentially slowing development, the automaker has just reported further production declines. To make matters worse, the shifting landscape of global trade, particularly the looming threat of tariffs, presents another major hurdle the brand will have to navigate.

More: Nissan Exec Warns “We Have 12 Or 14 Months To Survive”

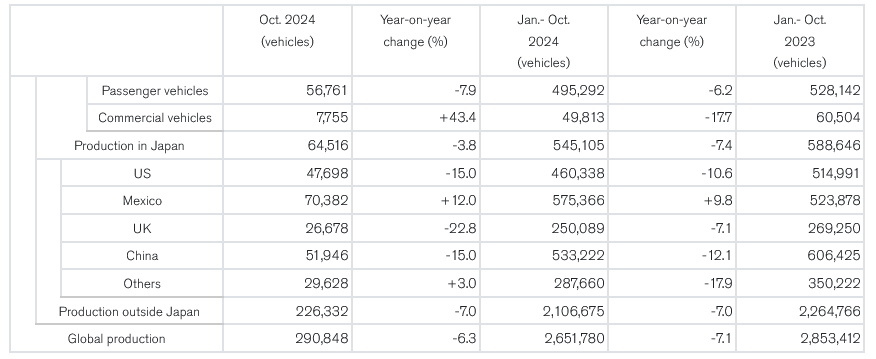

Globally, Nissan’s production is down 7.1 percent this year, a decline that spans several key markets. In the US, production has dropped by 10.6 percent, while Japan sees a 7.4 percent decrease, and China—a market Nissan has been heavily reliant on—suffers a 12.1 percent drop. The only country where Nissan has managed to increase output is Mexico, which saw a modest 9.8 percent bump in production. It’s almost as if Nissan has managed to put all its eggs in one very fragile basket.

A Bleak October

When looking at the October data compared to the same month last year, the numbers are even more grim. Production in the U.S. and China fell by 15 percent each, while the U.K. saw an even sharper 22 percent drop. Mexico, on the other hand, saw a 12 percent bump in October compared to the same month in 2023.

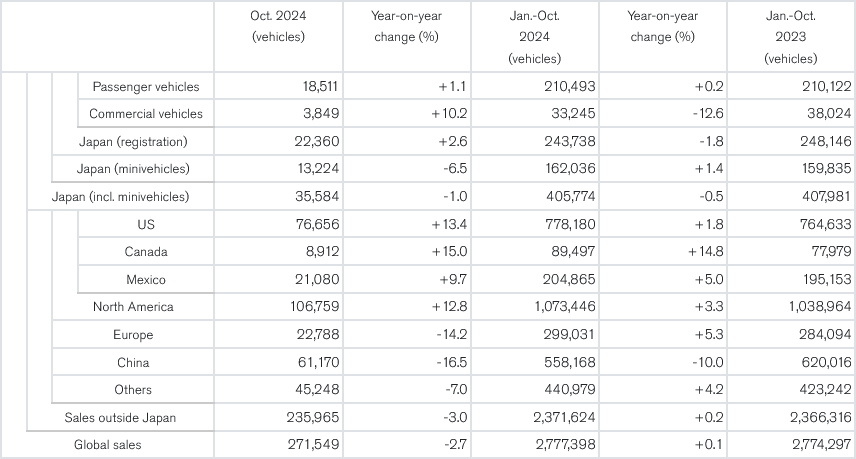

Interestingly, sales aren’t down, despite the production fall. Year-over-year, Nissan is actually up 0.1 percent in overall sales so far. By the end of October in 2023 it had sold 2,774, 297 cars globally. By the end of October 2024, it had moved 2,777,398 cars. Could it still end up in the negative by year’s end? Of course, but that might not be the biggest issue ahead.

Tariffs: The Next Big Threat

As noted by Reuters, President-elect Donald Trump has threatened to impose a 25 percent tariff on both Canada and Mexico once he assumes office. While many automakers rely on Mexican production, this potential tariff would hit Nissan harder than competitors like Ford, given the company’s significant reliance on its Mexican operations.

More: Nissan Slashes 9,000 Jobs, Sells Mitsubishi Shares, May Delay Some Of 30 New Models

According to an unnamed source within Nissan, the brand has around 12 to 14 months to turn things around. If the pressure continues to mount without a significant positive change for the brand, things could go from bad to worse. For a company already dealing with an uphill battle, this ticking clock could mark the difference between survival and collapse.

PRODUCTION

SALES