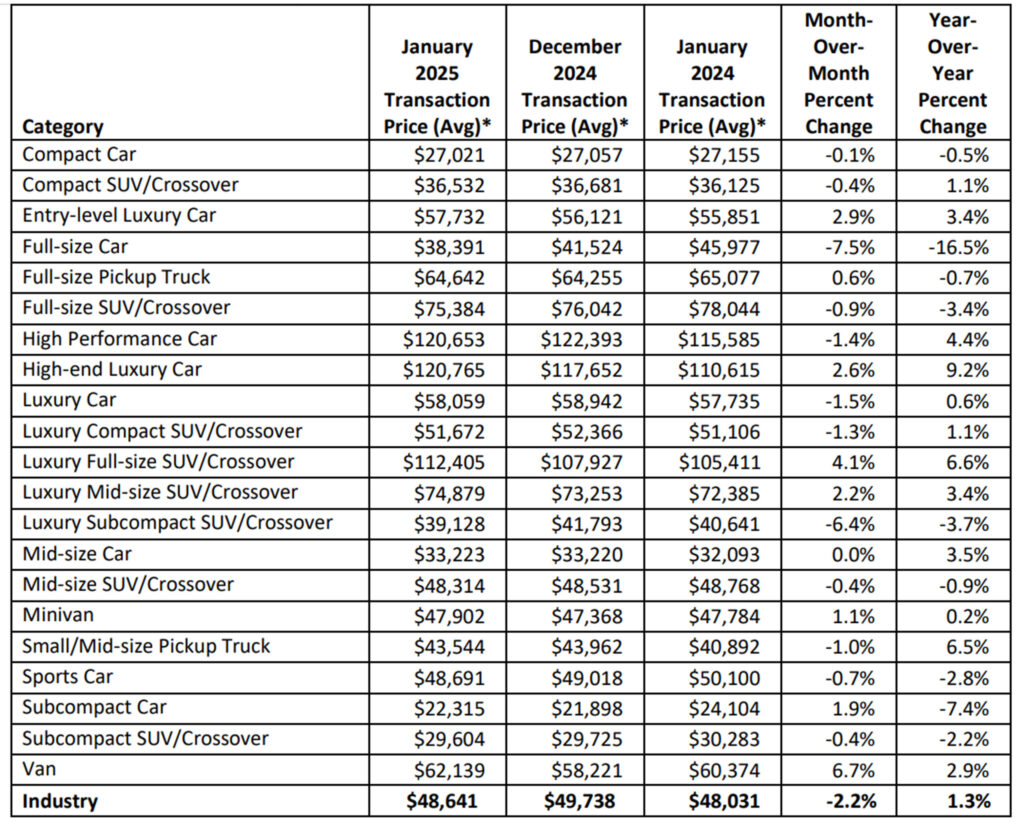

- The median time to afford a new vehicle in the Unites States dropped to 37.7 weeks.

- Incomes across the country grew by 3.6% year-over-year, according to Cox Automotive.

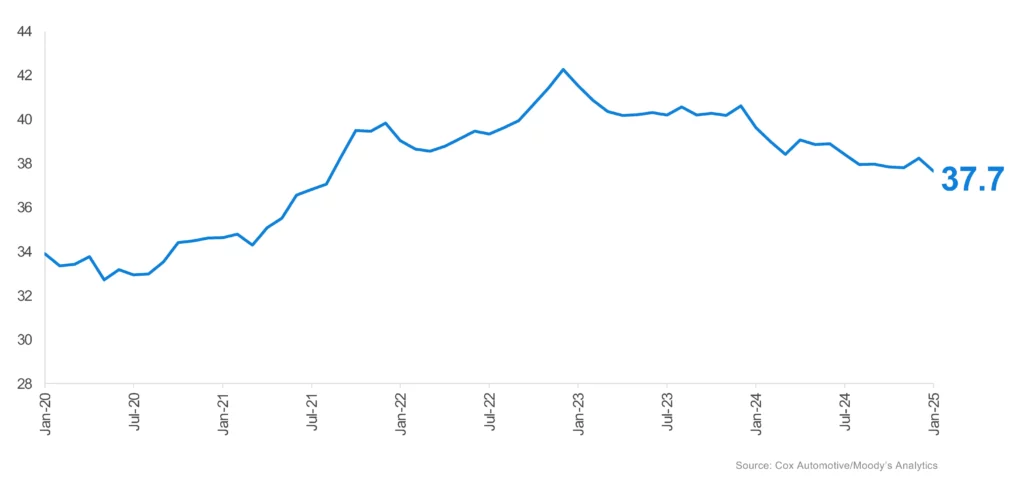

- The average transaction price of a new vehicle in the US fell to $48,641 in January.

While buying a new vehicle remains out of reach for many, those who can afford one will be pleased to know that their affordability is at its most favorable level in 41 months. This improvement comes thanks to a drop in the average price of a new car, coupled with growth in average annual income across the United States.

New data reveals that the median number of weeks needed to afford the average new vehicle in the US declined to 37.7 weeks in January, a fall from 38.2 weeks in December. This is also an improvement compared to 12 months ago, when an average of 39.6 weeks’ worth of income was required.

Price Drops and Income Growth Boost Affordability

According to Cox Automotive, the average price of new vehicles in the U.S. decreased by 2.2% in January, falling to $48,641. Although this is still higher than the $48,031 average transaction price (ATP) from a year ago, the trend is at least moving in a favorable direction for buyers.

Read: Average New Car Cost $48k, But Buyers Only Want To Spend $35k

At the same time prices fell, incomes grew by an average of 3.6% year over year. The average monthly car payment in January also decreased by 1.3% to $755, reflecting a 1.7% decline compared to the same time last year. This is notably lower than the $795 peak seen in December 2022.

“New-vehicle affordability received a boost from the lower prices typically observed in January following the luxury brand sales surge in December,” Cox Automotive chief economist Jonathan Smoke said. “These lower prices, combined with higher incomes, more than offset lower incentives and a slight increase in interest rates during January.”

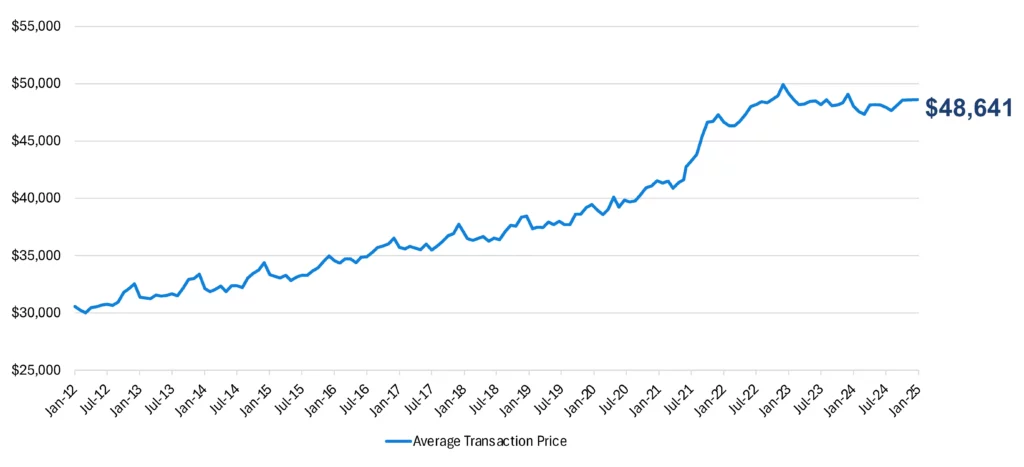

Several market segments contributed to the drop in ATPs across the country. For example, ATPs in the full-size car segment fell by 7.5% from December 2024, while prices in the luxury subcompact SUV/crossover category decreased by 6.4% month-over-month. Declines were also noted in the luxury car, luxury compact SUV/crossover, and high-performance car segments.

Notable Exceptions to the Downward Trend

Interestingly, not all segments followed this downward trend. Luxury full-size SUV/crossovers saw average prices rise by 4.1%, from $107,927 in December 2024 to $112,405 in January 2025. Similarly, high-end luxury cars experienced a 2.6% increase, with prices climbing from $117,652 in December 2024 to $120,765 in January this year.

While most buyers are getting better deals, some are seeing prices go up, depending on the type of vehicle they’re after. It just goes to show how things like buyer preferences and seasonal patterns can shake up the market. If you’re in the market for a new car, keeping an eye on these shifts might help you snag a better deal.

Average Transaction Prices For New Cars (January 2025)